格隆汇【实时解盘】| 网易目前是加仓的好机会吗?

上周,网易发布二季报,根据财报显示,网易公司第二季度净收入181.8亿元人民币,同比增长25.9%;归属于网易公司股东的持续经营净利润45.4亿元人民币,同比增长35.3%。

网易二季度的表现,不论是在营收还是净利润上均超市场预期,然而在业绩发布后,网易(NASDAQ:NTES)和网易-S(HK:09999)股价表现只能说平平。

图:网易业绩发布后一个交易日港美股股价

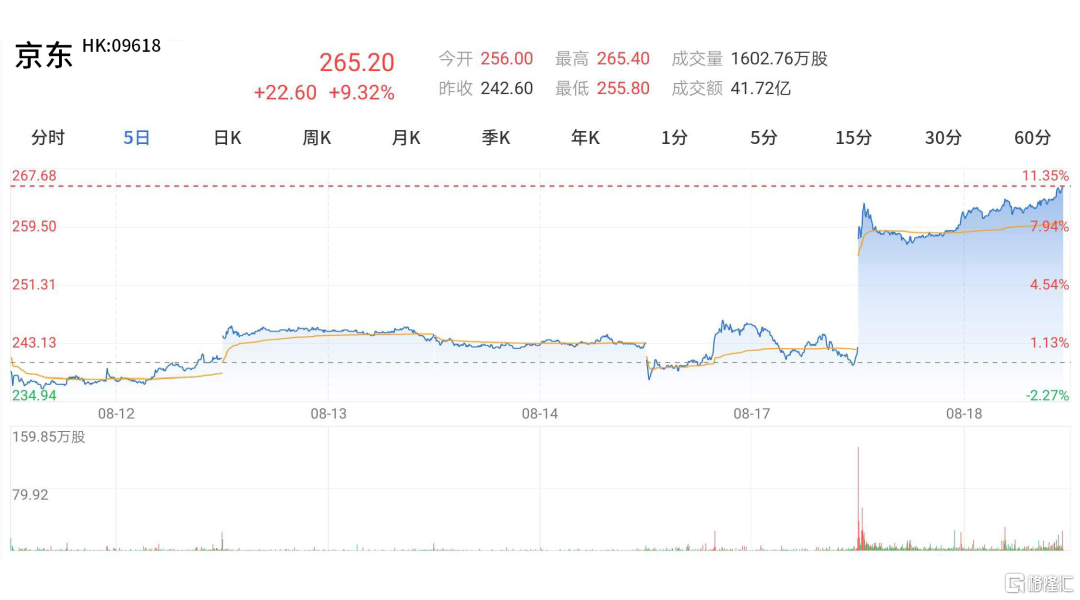

网易-S(HK:09999)今日收盘在147.6,涨3%。相比京东财报后9.48%涨幅,就显得比较平淡了。

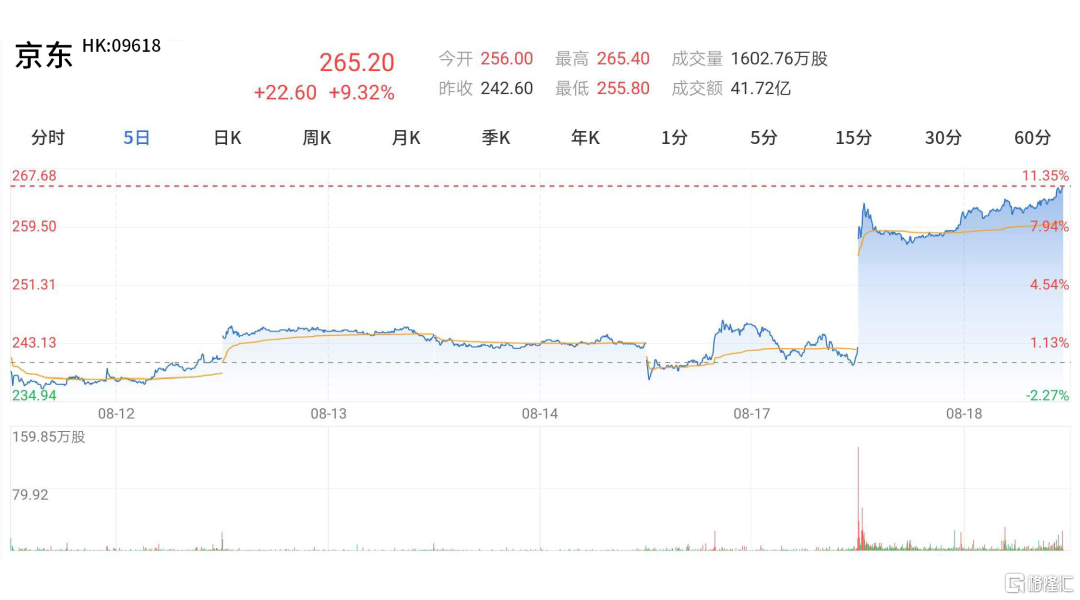

图:京东业绩发布后一个交易日港美股股价

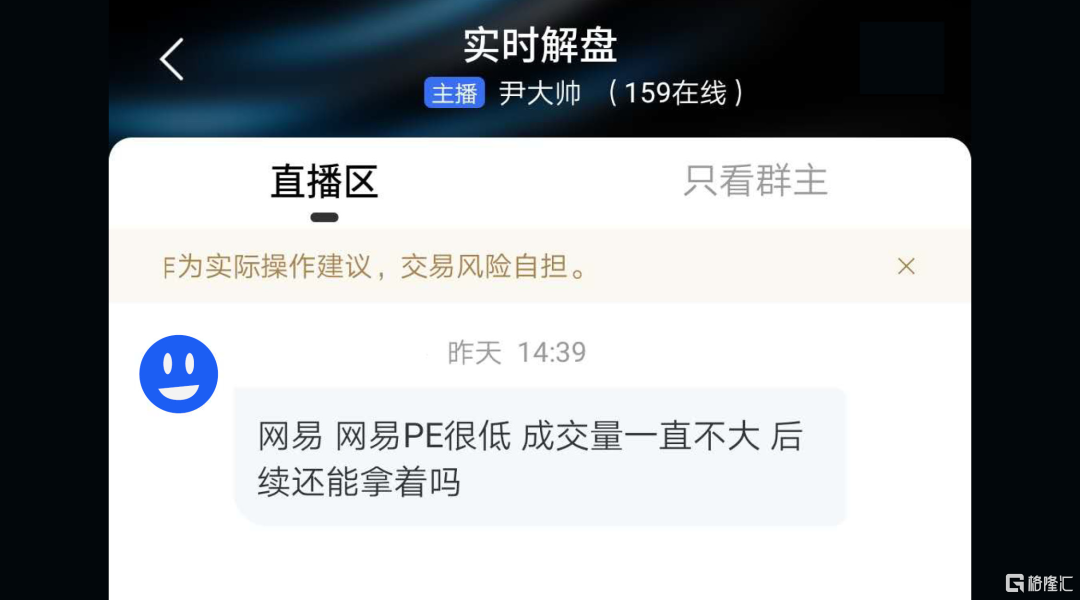

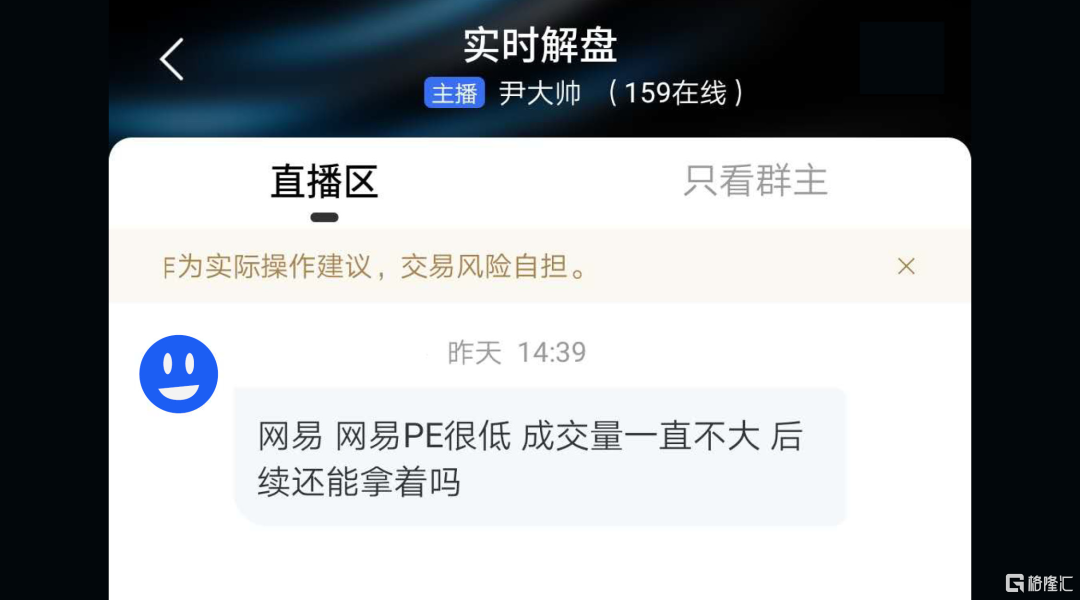

网易几日的表现,让人不禁好奇,这究竟是不是加仓的好机会?昨天在首席复盘直播间,有个小伙伴就问了这么一个问题。

图:格隆汇APP实时解盘截图

质疑估值和成交量,估值表示股票的想象空间,成交量代表标的短期热度,这两点都值得我们说道说道。

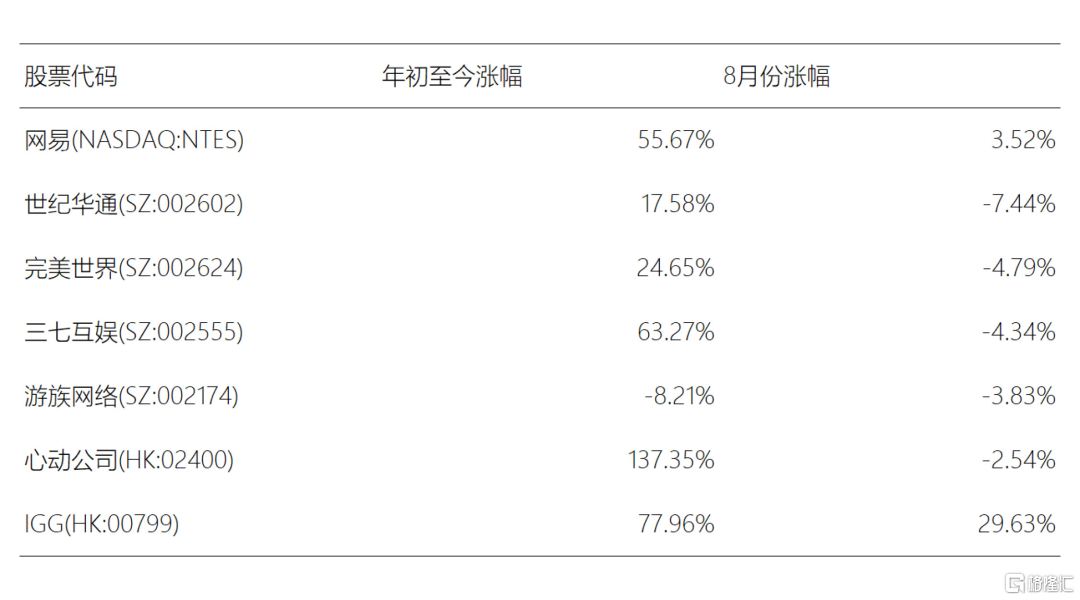

首先看到成交量,网易的成交量下降并不是个例。自从进入了八月份,不只网易,整个游戏板块都处在一个比较尴尬的境地!

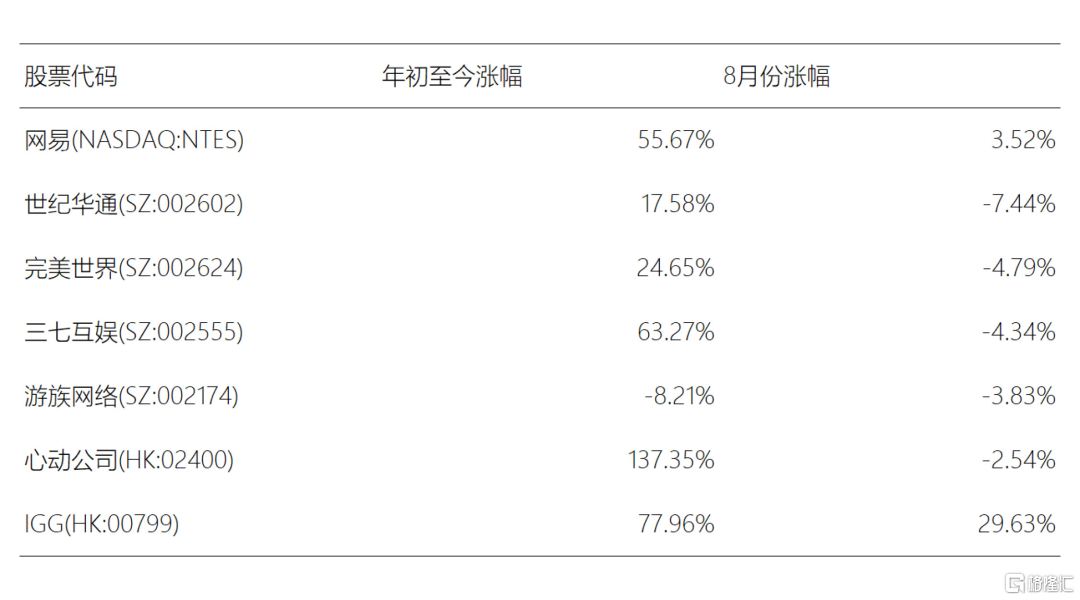

我们列举八月份至今主要游戏发行商的股价表现,网易小涨3.52%还算比较好的,世纪华通、完美世界、三七互娱等A股游戏龙头更是惨跌,只有港股的IGG一支独秀。

图:港、A主要游戏股年内涨幅和八月份涨幅

按理说,上半年受到疫情的影响,游戏用户增加,游戏企业大力抢占市场,整个板块应当是热门板块,下半年仍有望延续疫情带来的机会,然而进入下半年后板块就像被按了暂停键。

原因很简单,这个月,我们应该不只一次听到一句话:A股暂时不具备全面牛市条件。

不具备全面牛市的条件,换句话说也就意味着资金会持续在板块间轮动,八月份,我们听到有人在吹黄金、新基建、水泥、家装、大金融等等,但是真的比较少人听到游戏板块。而没有资金注水的游戏板块,自然表现平平。

其二看到估值。不论美股还是港股,目前网易动态市盈率都不到20x,相较港、A股的同行40倍左右的市盈率,无疑是有差距的。

图:港、A两地游戏股市盈率TTM估值

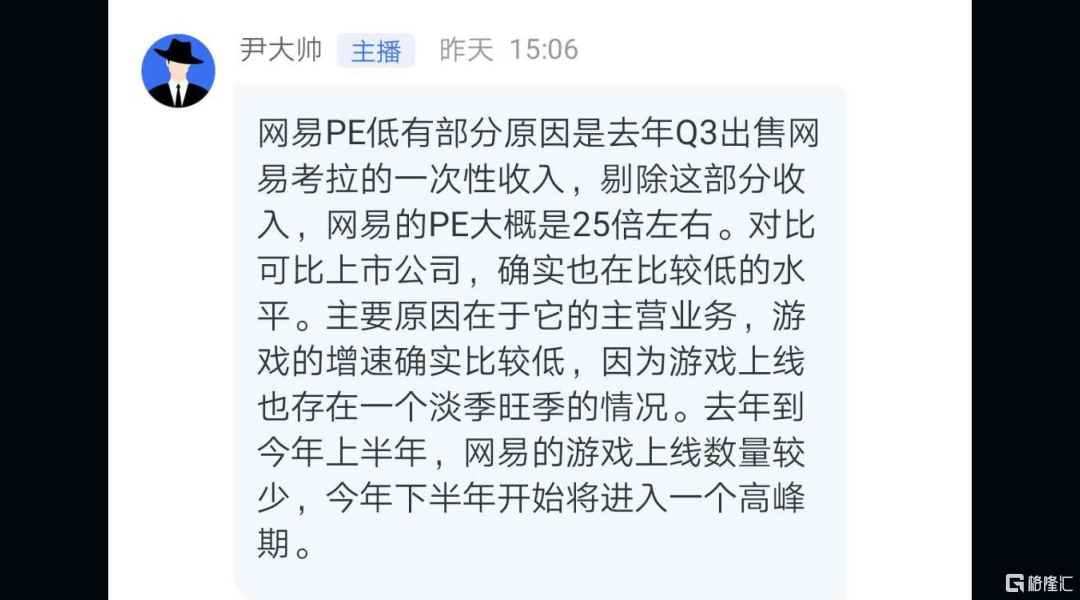

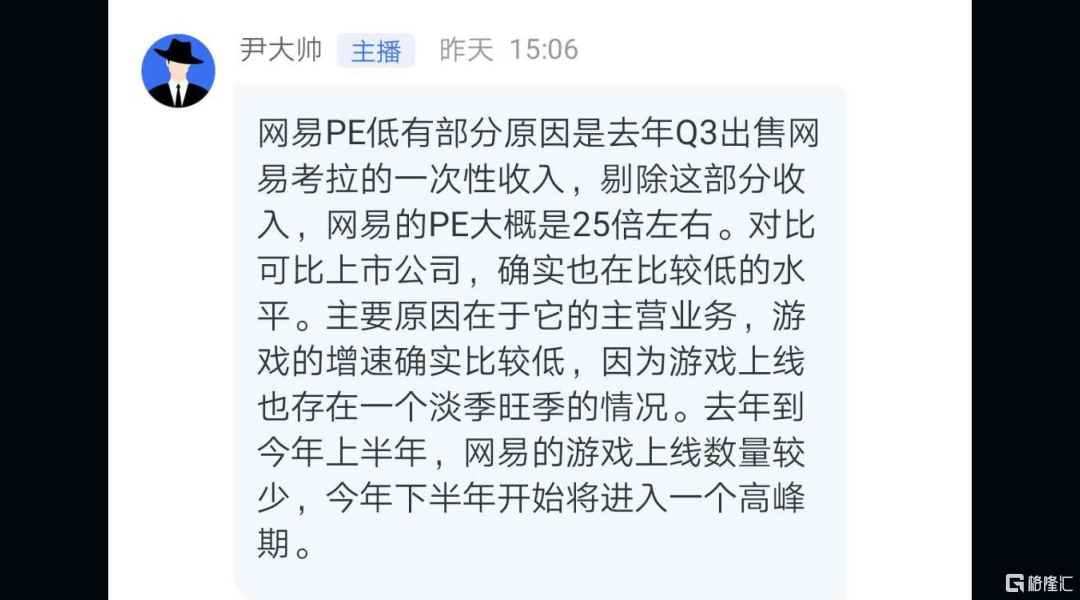

为何网易的估值和其他龙头差了一倍,在昨天的实时解盘中,格隆汇首席分析师尹大帅早已经给出了答案。

一、 剔除一次性收入影响

去年9月份阿里巴巴花了129.58亿元全资收购网易旗下的电商业务考拉。19年第三季度,网易持续经营净利润上涨到128.9亿元,而18年同期这个数字仅为20.62亿元人民币。剔除一次性收入影响,网易实际估值在25倍PE左右。

二、 下半年网易游戏迎高峰

在业绩发布后,陆续有投行机构发布分析报告也应证了这一点。野村预计公司第三及第四季度的在线游戏收入分别增长16%及29%。同时野村预计游戏业务四季度表现上行,因为目前公司预期有两款新游戏推出。

经过尹大帅的讲解,估值低下和成交不活跃看似不是问题,那么你还有信心继续持有网易吗?

好在无论如何今日网易高开2%,收盘来到147.6港元,涨幅3%,也算是稍稍争气!

格隆汇APP新功能【实时解盘】上线已经一周,格隆汇首席“尹大帅”携手众多研究员坐阵直播间,一天18小时在线为您解盘,抓不准股票或是大盘走势?欢迎随时上【实时解盘】寻求答案。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.