高盛上调阿里云估值至930亿美元,但估值水位低于亚马逊微软

来源:科创板日报

7月16日,高盛在最新评估中上调阿里云估值至930亿美元,较2个月前摩根大通给出的770亿美金估值上升超两成。分析认为,阿里云在规模和战略布局上有突出优势,市场正在调整其估值向亚马逊AWS靠拢。

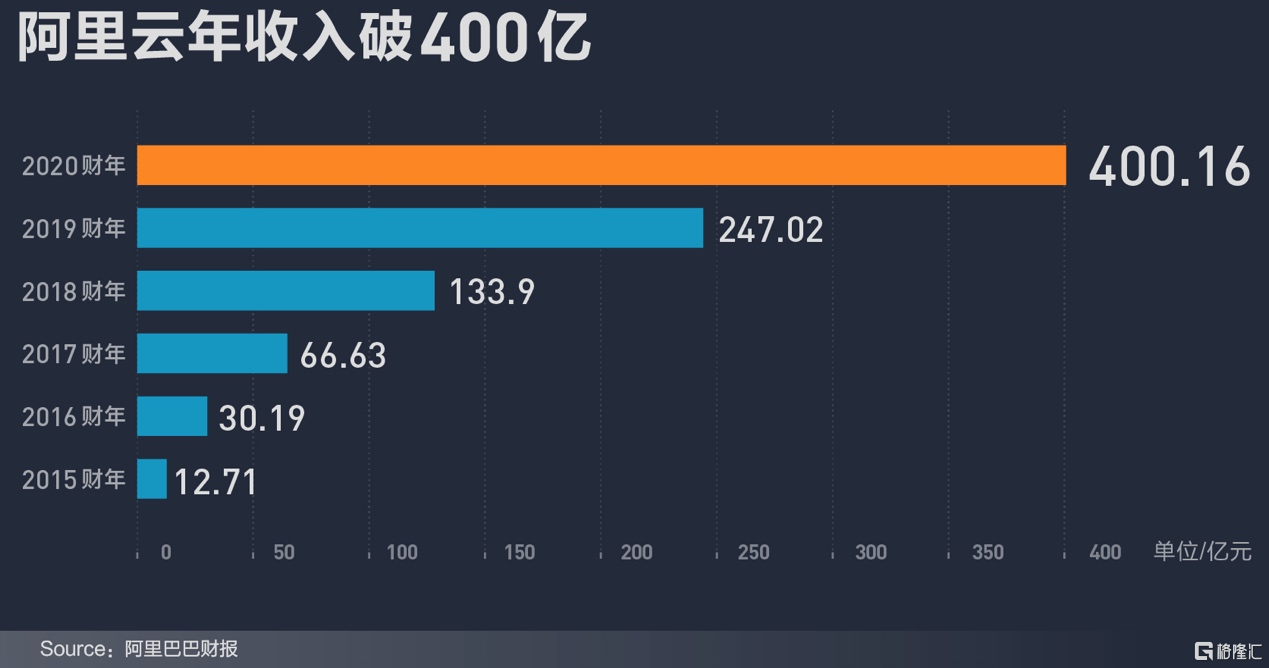

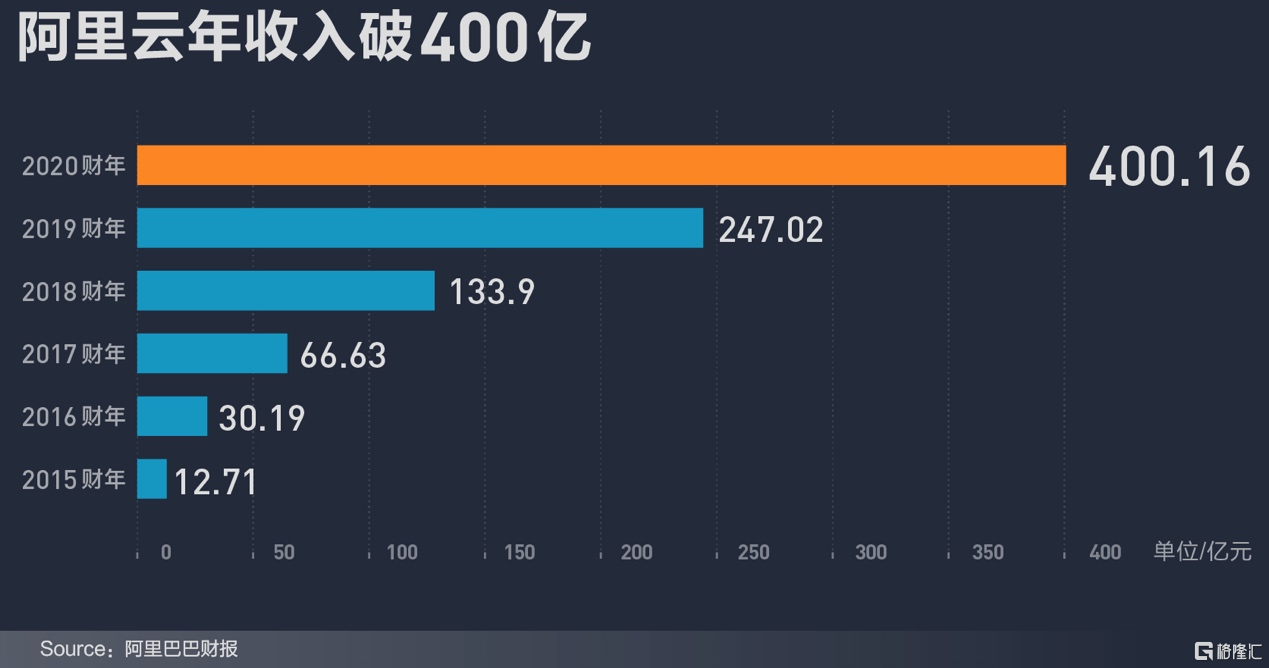

今年5月,阿里巴巴集团发布2020财年业绩,阿里云年收入达400亿元,在2018财年、2019财年,阿里云的营收分别为为133.9亿元人民币、247亿元人民币。

阿里云2020年财年业绩不仅同比增长62%,营收数据6年增长31倍。

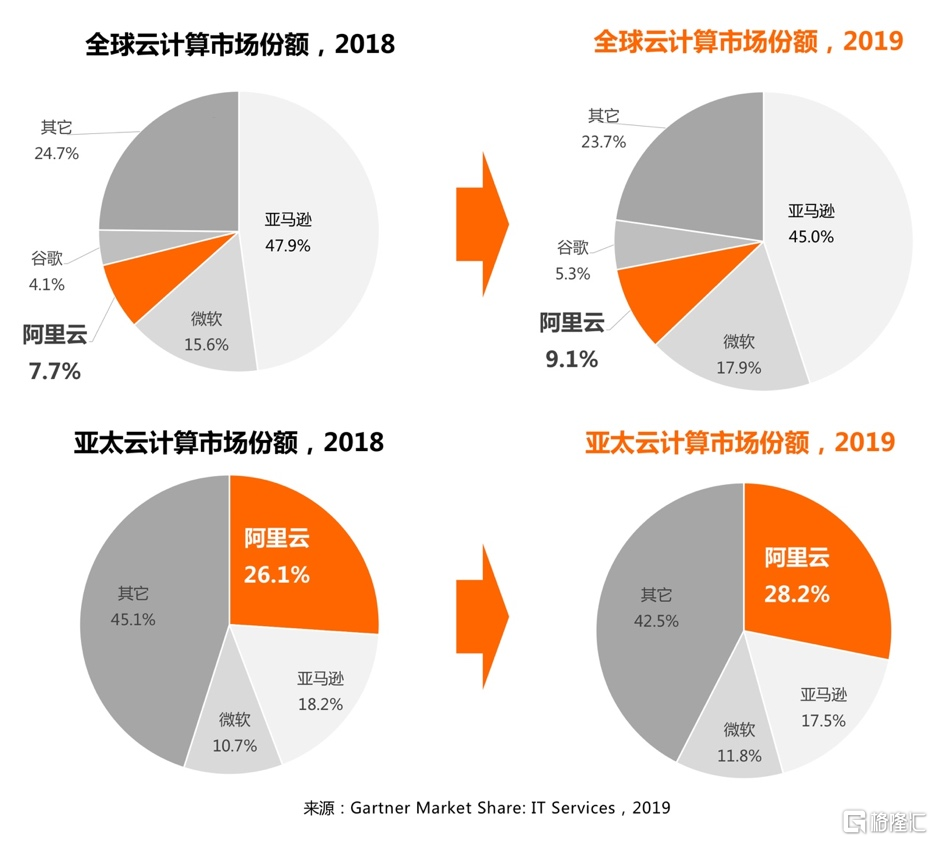

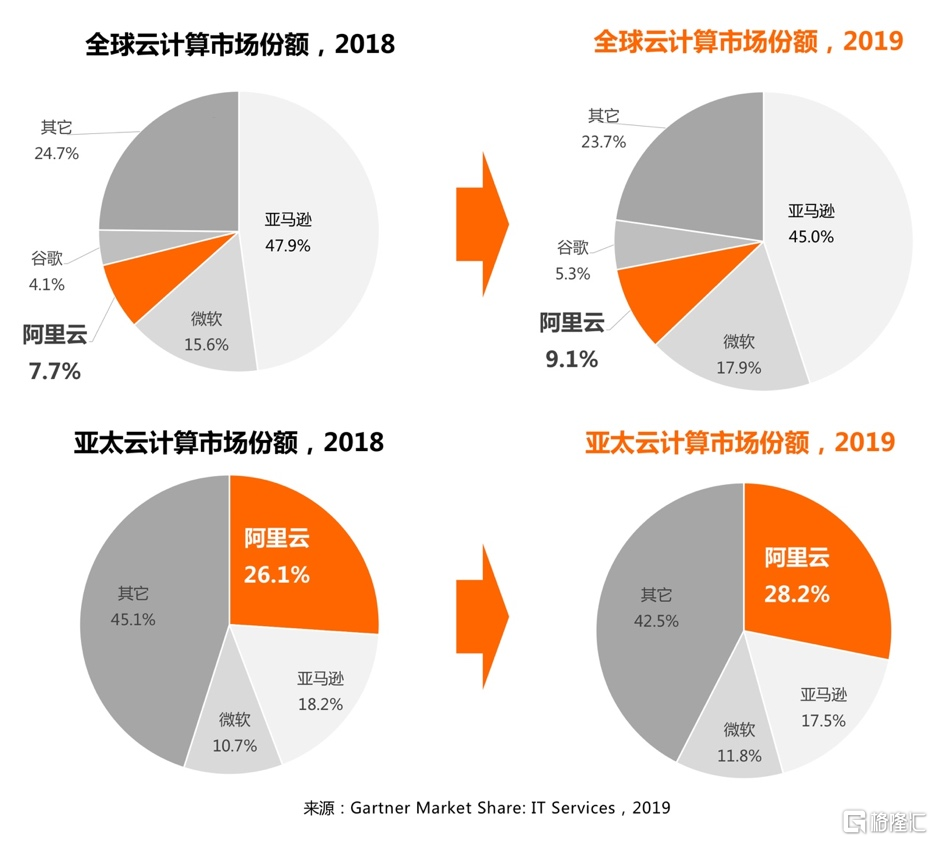

同时根据Gartner报告显示,2020年4月,阿里云是亚太地区最大的云计算厂商,市场份额从2018年的26%增长至28%,接近亚马逊AWS和微软Azure总和。在全球云计算IaaS市场,阿里云的份额从7.7%上涨至9.1%。在中国云计算市场,阿里云占有率达42%。

高盛预测,保守估计阿里云2022财年营收为834.07亿元人民币。由此,在对阿里云的估值中,选取834.07亿人民币作为营收数据,给予阿里云8.0倍市售率倍数,得出930亿美金的现行估值。并评价称未来其估值将从目前的8倍PS大幅向亚马逊AWS的14倍PS靠拢,带来估值大幅跃升。

除高盛外,KeyBanc也在最新报告中大幅上调阿里云估值。分析观点同样认为,疫情正在加速企业数字化进程,这将极大提高阿里云的发展潜力。同时,钉钉用户数已突破3亿,企业组织数突破1500万家,为全球150个国家和地区提供服务,未来将推动阿里云的估值进一步提升。

高盛对阿里云采用了“市售率”估值法(PS估值法),为一种常用于云计算的方法,目前,对亚马逊AWS、微软Azure、谷歌云等公司,均采用此种方法。

亚马逊、微软、阿里云、谷歌,分别是全球云计算市场前四名。

2020年7月,在高盛对阿里云估值的报告中,给予亚马逊的市售率为14倍。2019财年,微软营收为1258亿美元,未单独拆分云业务Azure营收进行披露。微软集团整体市售率约为8倍左右。德意志银行两位分析师的研究报告称,谷歌云价值2250亿美元,给出的谷歌云的前瞻市销率约为13.23倍。

对于几家全球领军的云计算厂商,分析机构普遍给予的市售率在8到14倍左右。高盛目前给予阿里云8倍的市售率,并不算“高”。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.