暗盘高开7%,6.18京东香港IPO会涨多少?

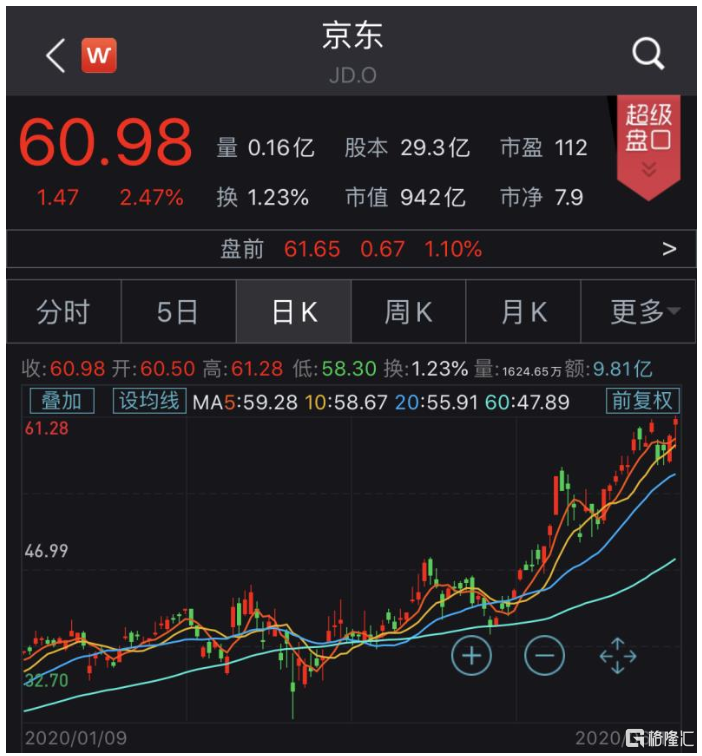

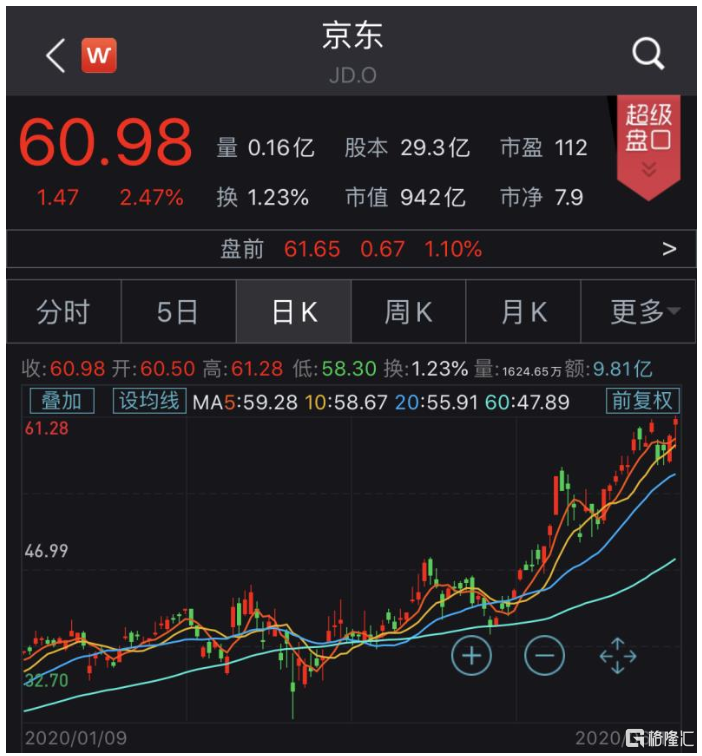

6月17日早间,京东集团发布发售价及配发结果公告。最终发售价均为每股226港元,较美股周二收市价(60.98美元)低4.4%。估计募集资金净额约297.71亿港元。将于2020年6月18日上午9时正开始于香港联交所主板买卖,股份代号为9618。

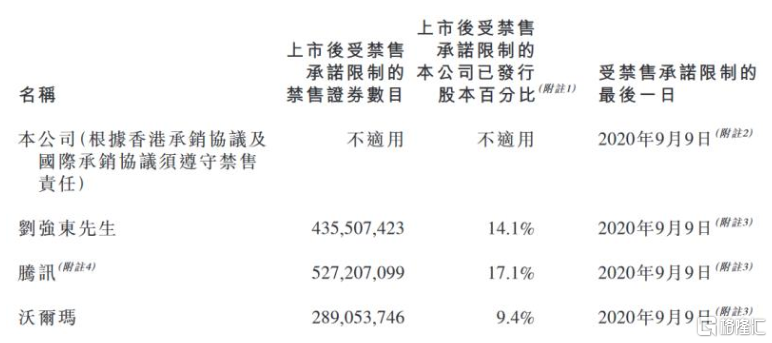

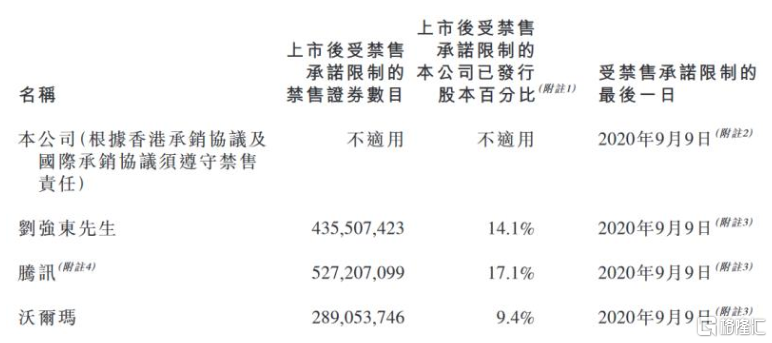

据京东提供的招股书显示,京东的最新持股情况:刘强东持股4.485亿股普通股,占股15.1%,投票权为78.4%。腾讯持股5.272亿股普通股,占股17.8%,为最大股东,投票权为4.6%。沃尔玛持股2.89亿股普通股,占股9.8%,投票权为2.5%。

6.17京东综合各暗盘交易场,富途暗盘交易场,京东现报243元,较招股价226元高7.5%,一手(50股)帐面赚850元;耀才暗盘,京东现报238.6元,较招股价升5.7%;辉立暗盘京东现报239.6元,较招股价升6%。

信诚证券联席董事张智威称,截至昨美股收市折算港元计算,港股京东较美股存有4.4%升水位,若投资者希望短期获利,可考虑于240元卖出。但京东和网易一样适宜长期持有,不着急回笼资金的可忽略短期股价变化。

此次京东港股认购是三家回归中概股中,中签率最低的。无论从吸引投资者数量、冻结资金金额,还是募集资金规模上,均创下了港股今年以来的新高。

据6月17日港交所发布的最新公告显示,京东此次香港公开发售总计获得396,096份有效申请,合计认购1,189,655,500股香港发售股份,相当于香港公开发售项下初步可认购6,650,000份香港发售股份总数的近180倍。

根据京东集团此前在招股书中所设定的回拨机制,由于此次香港公开发售超额认购超过100倍,因此将部分国际发售股份分配至香港公开发售,由此将香港公开发售部分的比例从5%提升到12%。

按照此前确定的香港公开发售每股最高236港元计算,京东此次香港公开发售将冻结资金达到2807.6亿港元,这一金额将超出2018年以来赴港上市的小米、阿里巴巴及网易的冻结资金规模。

回顾京东近年来的发展,自其在美上市以来的6年间净收入增长8.3倍,同时净利润增长48倍;年度活跃用户数从4740万激增至3.87亿元,增长近8.2倍;自由现金流增长8.3倍;员工数也从3.3万人增长至22万人。

在美上市的京东,今年股价不断刷新历史记录,年初截止本周二收盘涨73.07%,总市值942亿美元。对比阿里上市周日涨幅6.59%,网易上市首日升5.69%,京东会涨多少?

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.