滔搏(06110.HK):渠道优化及数字化管理如期推进,疫情影响H2零售承压,维持“增持”评级

机构:东吴证券

评级:增持

投资要点

事件:公司披露截至 2020/2/29 财年年报,收入 336.9 亿元(+3.5%) ,上/下半财年收入同比分别+12.4%/-4.6%,其中销售货品/联营费用/电竞收入分别达到 334/2.7/0亿元;归母净利 23.0亿元(+4.7%) ,若剔除上市费用及企业合并产生无形资产摊销影响,归母净利 23.8亿元(+6.5%) 。

前 11月零售表现好于预期,但疫情影响 2月零售。20财年前11个月公司收入增速大于 13%,经营利润增速大于 20%,整体增长趋势与 FY20H1保持一致且增速略快于上半年,但最终报表受到 2月疫情影响,销售货品收入 334亿(+3.3%) ,其中:

1)核心品牌表现仍然坚挺:本财年 Nike、Adidas品牌销售收入 294.9 亿(+4.4%)上下半财年分别+10.7%/-1.4%,表现坚挺;非核心品牌的其他品牌收入 39.0 亿(4.2%),上下半财年分别+27.5%/-22.9%,下半年销售下滑与公司与个别品牌停止合作以及将部分低效店铺进行梳理有关。

2)直营下半年因疫情承压:直营收入 291.7亿(+0.7%),上/下半财年分别+11.7%8.5%,下半年增速放缓估计与其他品牌销售下半年同比下降较多有关;批发收入42.2 亿(+25.8%),上下半财年分别+17.6%/+35.4%。

3)渠道优化继续:财年内直营门店新增/关闭门店 1416/1364 家,门店总数净增 5家至 8395家,大店策略下门店毛面积增幅达到 10.6%;门店中,300平米以上门店数量占比提升 2.3pp 至 7.3%(612 家) ,150-300 平米门店占比提升 0.7pp 至 24.4%(2051家) 。

会员运营愈加完善,数字化运营助力疫情期间销售工作:年内继续通过丰富福利和活动吸引会员,截至 2月底累计注册会员 2720万(+92%) ,会员贡献零售占比提升到 91%(去年同期 52.3%) ;疫情发生后亦充分利用规模化会员基础进行老带新活动和非会员的激活活动,加大社群营销和内容互动,全面启动线上线下库存联通和共享,数字化零售在直营零售的占比从中高单位数上升到疫情高峰期的 40%,并在疫情缓和后稳定在 10%-20%。

盈利能力稳健、营运效率维持高水准。财年内受益更严格的折扣控制公司毛利率提升 0.3pp至 42.1%;剔除上市费用及企业合并因素,营业利润33.90亿元(+3.3%)疫情影响下营业利润率仍达到同比持平; 归母净利 23.81亿元 (+6.5%) , 净利率 7.1%(+0.2pp) ,盈利能力持续提升;同时 2月末作为疫情影响最严重时期公司存货规模同比仅上升 8.3%至 66.5亿元,应收账款规模同比下降 41%至 14.9亿元,叠加应付款余额上行,带来营运资本增加,20财年经营性现金流同比增长 105%至 64亿元

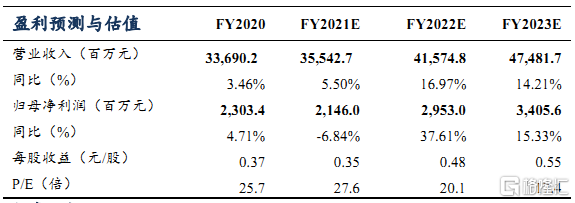

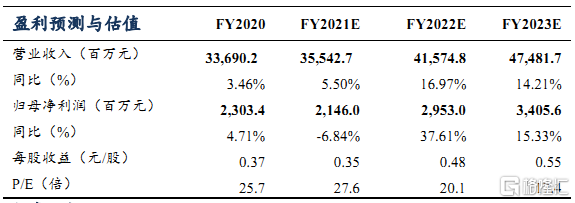

盈利预测与投资评级:我们预计 2021 财年 3-6月零售增长及折扣率受到疫情影响7 月后零售有望恢复正常,2022 财年则回到收入中双位数增长、净利率 7.1%状态(净利率与 FY2020 基本持平),由此,预计 FY2021/2022/2023 年收入同增5.5%/17.0%/14.2%至 355/416/475 亿元,归母净利同比-6.8%/37.6%/15.3%至21.5/29.5/34.1 亿元,对应当前市值 PE28/20/17X,作为我国第一大体育服饰经销商竞争力仍然突出,考虑估值及增长中枢匹配度,维持“增持”评级。

风险提示:疫情影响超出预期、合作品牌市场竞争力下降

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.