希望教育(1765.HK):19财年强劲业绩彰显管理执行力,维持买入评级,目标价2.2港元

机构:招商证券

评级:买入

目标价:2.2港元

■ 19财年业绩符合预期,核心净利润同比增长51%,收入提升,毛利率及 经营利率均有所改善

■ 2019/20 学年学生人数达到14万(同比增加63%);内生增长、新增并 购、自建学校三管齐下,助力长期增长

■ 近期估值吸引力强,盈利增长轨迹清晰,看好下一个强劲业绩年度

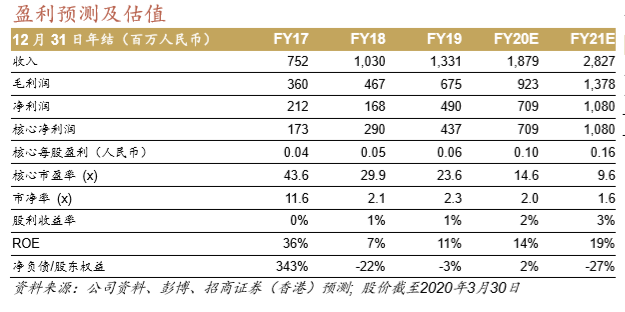

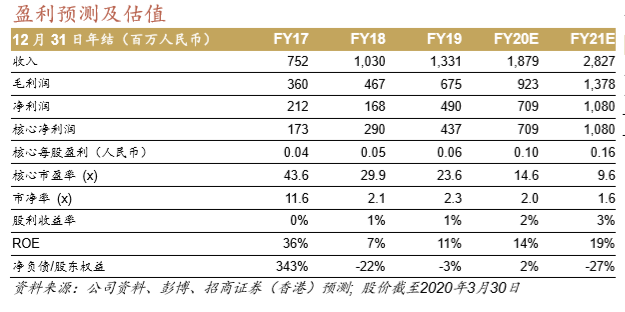

19财年盈利增长亮眼

19财年收入达13.3亿元人民币,同比增加29%,毛利及经营利润均有同比 40%的增长,受益于利润率的提高(同比增加4至5个百分点)。核心净利 润达4.37亿元人民币,同比增加51%(调整项为汇兑损益、2018年上市费 用、处置/公允价值损益等)。基于0.065元人民币的核心每股盈利,希望宣 布派发每股0.023元人民币的现金股息,对应35%的分红比率,相比于18财 年32%的分红比例有所提升。由于收购了4所新的学校(银川、苏州、鹤壁 和贵州学校),资产负债表净现金水平有所降低。总负债同比增加22%至 26亿元人民币,净现金/权益比率为3%。

新增学校贡献盈利,20财年前景良好

虽然管理层并未提供详细并购计划目标,但希望的内生增长、新增并购及 自建学校三管齐下策略不变。管理层强调现有学校贡献了60%的收入增 长。这些现有学校仅占集团40%的成本增长,因而帮助集团拉高了利润 率。管理层对于新并购学校的利润率提升非常有信心,预计未来三年鹤 壁、苏州和银川学校的盈利年复合增长率分别为89%、88.6%和60%。我 们预计20财年核心盈利增长率为63%,主要受益于新增学校的完全并表。 最近收购的马来西亚学校预计在2021年初并表,将贡献20%的预测收入及 6%的盈利。

近期回调提供买入机会

我们将20/21财年的预测核心每股盈利分别调整-7.3%/+16.7%,反映了:1) 学生人数的加速增长;2)19财年实际业绩数据调整;及3)将一所重庆的自 建学校并表到20财年业绩中,将马来西亚学校并表到21财年业绩中。我们 维持2.2港元的目标价不变。在近期市场受新冠肺炎疫情震荡之后,希望教 育的股价从3月3日的峰值下跌11%,希望目前20/21财年前瞻市盈率倍数分 别为15倍/10倍,相对于行业平均为12倍/10倍。相对中教(839 HK)和宇华 (6169 HK)分别有23%和17%的20财年市盈率折让。由于希望相对较高的盈 利增长质量和管理执行能力,我们继续看好希望,预计其与中教和宇华的 估值折让将会进一步缩窄。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.