ADR, or American Depository Receipt, is a financial instrument issued by U.S. depository banks and traded on U.S. securities markets to represent shares of foreign companies. It allows U.S. investors to purchase and trade foreign company stocks on U.S. exchanges without directly engaging in foreign markets. Each ADR represents a corresponding amount of stock in the listed company based on an exchange ratio.

Background and Origins

According to U.S. government policies, foreign companies are not allowed to directly list on U.S. securities markets. To raise capital in the U.S. market, foreign companies have two main routes:

- Direct Listing: A foreign company establishes a subsidiary in the U.S. and moves the parent company’s listing to the U.S. company, then lists its shares. This process often involves complex legal procedures, high costs, long listing times, and heavy tax burdens.

- Indirect Listing: Through ADRs/ADSs (American Depository Shares). In this case, foreign companies do not need to register a subsidiary or move their headquarters to the U.S. Instead, they issue ADRs/ADSs via U.S.-based depository banks, enabling their shares to be traded on U.S. exchanges.

Advantages

This method not only allows foreign companies to avoid the complexities of the U.S. regulatory environment but also provides U.S. investors with more investment choices. Moreover, trading ADRs in U.S. markets provides companies with increased liquidity and financing opportunities. Since only receipts are traded, investors do not need to worry about exchange rate differences or setting up specialized brokerage accounts. Additionally, investors have the right to receive all dividends and capital gains, simplifying the process of trading foreign stocks.

Here are some examples of Hong Kong-listed companies with ADRs

|

Company Name |

HK Stock Code |

ADR Code |

Industry |

ADR Trading Market |

|

Alibaba Group |

9988 |

BABA |

E-commerce, Cloud Computing |

New York Stock Exchange (NYSE) |

|

Tencent Holdings |

0700 |

TCEHY |

Social Media, Online Gaming |

Over-the-Counter (OTC) |

|

Meituan |

3690 |

MPNGF |

Local Services, Food Delivery |

Over-the-Counter (OTC) |

|

China Mobile |

0941 |

CHL |

Telecommunications |

Over-the-Counter (OTC) |

|

Xiaomi Corporation |

1810 |

XIACY |

Telecommunications Equipment |

Over-the-Counter (OTC) |

*Data sourced from April 1, 2025; information from respective websites

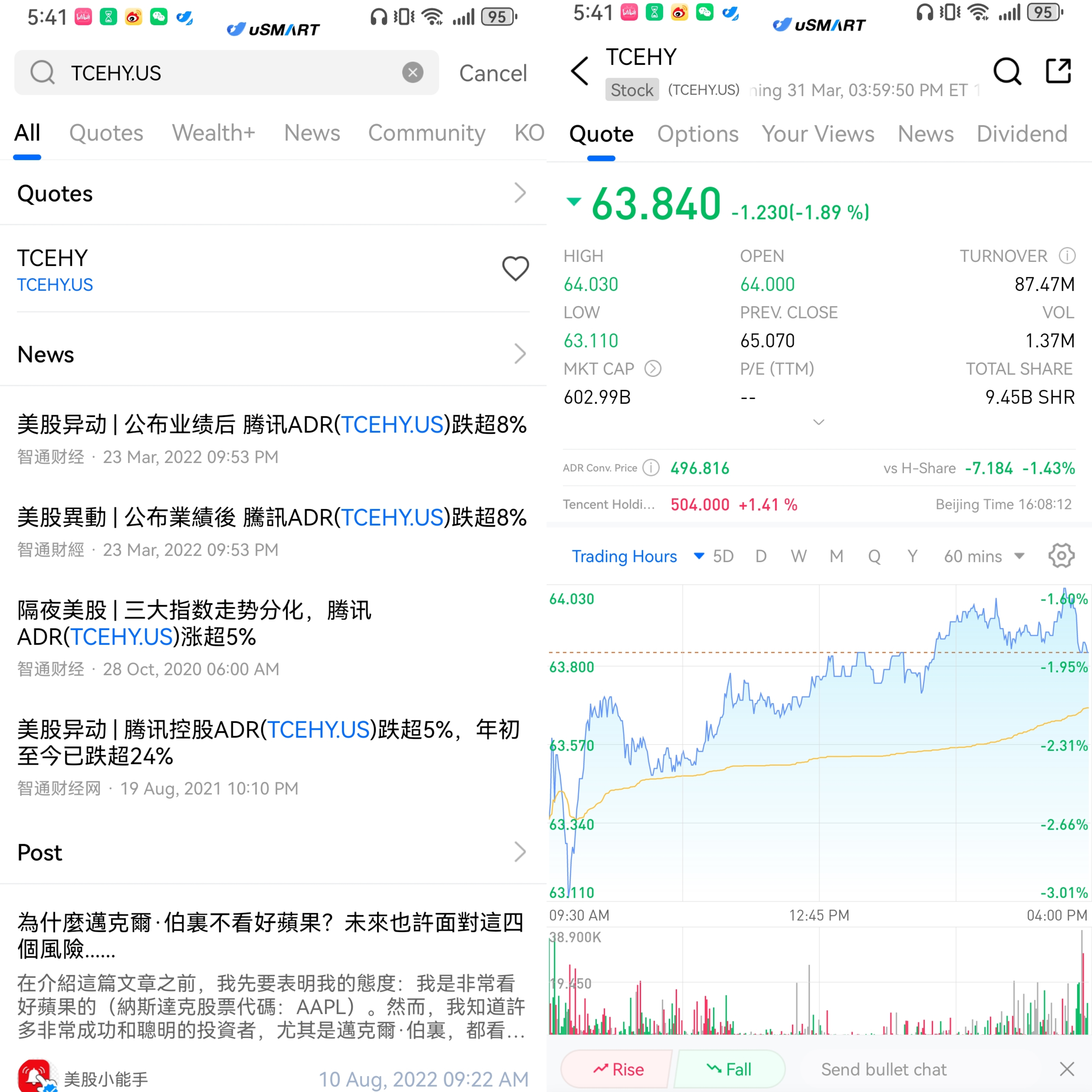

How to purchase Hong Kong stock ADRs on uSMART

First, log into the uSMART HK app and tap the 'Search' option in the top-right corner of the page. Enter the stock code, such as 'TCEHY.US,' to access the detail page where you can view trading details and historical trends. Next, tap the 'Trade' button in the bottom-right corner and select the 'Buy/Sell' option. Finally, fill in your trading conditions and submit the order.

(Image source: uSMART HK)