On July 4, food and electronics trading company Hong Kong Chaoshang Group (02322.HK) announced the signing of a memorandum of understanding with the Saudi Public Investment Fund (PIF). Under the agreement, PIF's Asia division will invest US $500 million (approximately HK $3.9 billion) in the company.

At the opening of the Hong Kong stock market on July 5, Chaoshang Group (02322.HK) opened 4.94% higher at HK $0.85, and then expanded its gains to as high as HK $0.89, an increase of 9.88%. At the time of writing, Chaoshang Group (02322.HK) was trading at HK $0.79, down 2.469%.

According to the MOU, PIF intends to make two investments in Hong Kong Chaoshan Group, including a five-year financing of US $100 million through convertible bonds and a five-year financing of US $400 million through loans. If the convertible bonds are exercised at the current price, the US $100 million (HK $780 million) could be converted into 960 million shares, representing approximately 23.3 per cent of the current total share capital of 4.126 billion shares, or approximately 19 per cent of diluted equity.

The memorandum is not legally binding and the parties will negotiate further over the next three months to enter into a definitive agreement.

Saudi sovereign fund PIF: The global investment powerhouse driving the future

What is the Saudi Sovereign Fund PIF?

Saudi Arabia's Public Investment Fund (PIF) is one of the world's largest sovereign wealth funds. Assets under management in 2023 is about $700 billion, ranking seventh in the global sovereign fund ranking. PIF was established in 1971 with the aim of diversifying and sustainable development of Saudi Arabia's economy through investment.

In 2016, Saudi Arabia announced a plan called Vision 2030, which aims to increase the diversification of the kingdom through infrastructure, tourism, technology and health, and accelerate the transformation of the country's economic and financial landscape. PIF's board of directors said PIF's investment strategy is in line with the Government's Vision 2030 to diversify the economy. To bolster the PIF's resources and help finance investments by foreign companies such as Uber and Tesla, the PIF receives cash from the Saudi Central Bank, issues debt, and benefits from proceeds from assets privatized by the Saudi state.

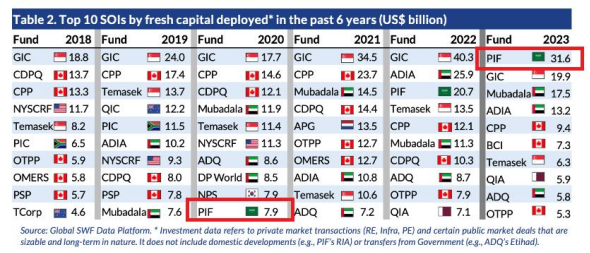

Global SWF's latest annual report revealed that in terms of frequency of investment activity, PIF led all SWFS as the most active investor in 2023, allocating $31.6 billion across 49 deals, a 33% increase over the previous year.

This progress has lifted the fund's annual new capital allocation ranking by 10 places among global sovereign investors in just three years.

Saudi Arabia's sovereign wealth fund, the Public Investment Fund (PIF), will have $2 trillion in assets under management by 2030, vaulting it to second place among Global sovereign wealth institutions, according to projections by the Global SWF.

PIF's eight investment pools

- Saudi Equity Holdings (SEH) : This investment pool will account for 32% of the total PIF assets under management in 2022. This investment pool mainly invests in supporting Saudi listed companies. The focus of this pool is to increase support for domestic listed companies through shareholding to promote the development of the local economy.

- Saudi Sector Development Pool (SSD) : In 2022, this investment pool consists of 80 companies with a combined size of approximately $125 billion, or 21% of the total size of the PIF. The investment pool aims to boost key sectors in the kingdom, including energy, tourism and entertainment.

- Saudi Real Estate and Infrastructure Development Pool (SREID) : This investment has approximately $54 billion under management in 2022, accounting for 9% of the total PIF. The SREID Investment Pool is focused on managing strategic real estate and infrastructure projects in the Kingdom with the aim of improving the utilization and maximizing the value of the land bank. PIF also seeks to build new infrastructure in major cities to drive economic growth. The fund will also develop housing and tourism projects to attract capital from real estate companies as well as domestic and foreign investors.

- Saudi Giga-Projects (SGP) : This investment will have approximately $32 billion under management in 2022, representing 5% of the total PIF. PIF has four transformative projects in its portfolio that maintain significant scale while making a significant contribution to the Kingdom's strategic objectives of supporting new industries, industries and businesses, and ultimately creating new economic opportunities. The four super projects - NEOM, ROSHN, Qiddiya and Red Sea Global - are all backed by the SGP investment Pool. The NEOM, ROSHN, Qiddiya and Red Sea Global projects represent Saudi Arabia's most cutting-edge investments in innovative cities, sustainable development and tourism and entertainment.

- International Strategic Investments (ISI) : This investment has approximately $62 billion under management in 2022, accounting for 10% of the total PIF. The portfolio within the ISI investment pool includes large investments in a range of well-known companies, innovative unicorns and industry leaders (LUCID, Uber, Blackstone, SoftBank, etc.) around the world. This diversified approach to investment ensures a balanced approach to risk, enabling PIF to build long-term relationships and expand its brand and reach.

- International Diversified Pool (IDP) : This investment has approximately $29 billion under management in 2022, accounting for 3% of the total PIF. IDP seeks to maximize long-term returns by investing in liquid and illiquid international assets, with predetermined risk appetite and thresholds, leveraging global deep asset classes, including fixed income, public equities, private equity, real estate and infrastructure, alternative investments (including hedge funds) and direct investments.

- International Capital Markets Program (ICMP) : This investment pool will have approximately $45 billion in assets under management in 2022, representing 8% of the total PIF. ICMP is more speculative in nature, opportunistically investing in selected emerging global regions and industries, including telecommunications, energy, consumer goods, financials, healthcare, information technology, and more.

- Treasury Pool (TP) : This investment has approximately $54 billion under management in 2022, accounting for 9% of the total PIF. TP continuously evaluates and forecasts the PIF's liquidity position to identify any shortfalls and funding needs, ensuring that capital is available for PIF's strategic target investments.

Investment case

Lucid Group

Holdings: PIF owns approximately 1.015 billion shares of Lucid Group.

Holding market value: As of the relevant report, the holding market value is approximately $25.787 billion.

Investment Background: Lucid Group is a Us-Based electric vehicle manufacturer focused on the production of high-performance electric vehicles. PIF's investment aims to support the development of sustainable transport and drive Saudi innovation in the field of new energy vehicles.

Activision Blizzard

Holdings: PIF owns approximately 37.87 million shares of Activision Blizzard.

Holding market value: The holding market value is about 3.034 billion US dollars.

Investment background: Activision Blizzard is the world's leading game development and publishing company, with "Call of Duty", "World of Warcraft" and other well-known games. PIF's investment reflects its confidence in the growth potential of the global entertainment and esports market.

Red Sea tourism development project

Project Company: PIF is responsible for the development of the project through its holdings in Red Sea Development Company and Amaala Company.

Amount of investment: The total investment of the project is expected to be billions of dollars.

Project background: The Red Sea Tourism Development Project aims to create a world-class tourist destination, including luxury resorts, ecotourism and cultural heritage protection, with the aim of attracting international tourists and promoting the development of tourism in Saudi Arabia.