批零贸易业大消费行业2020年投资策略:消费行业的小龙头时代

机构:国泰君安

本报告导读:

消费进入下半场,2020年市场热点可能会从大龙头走向小龙头,重点关注行业需求红利仍在、竞争格局逐渐清晰的小龙头企业。

摘要:

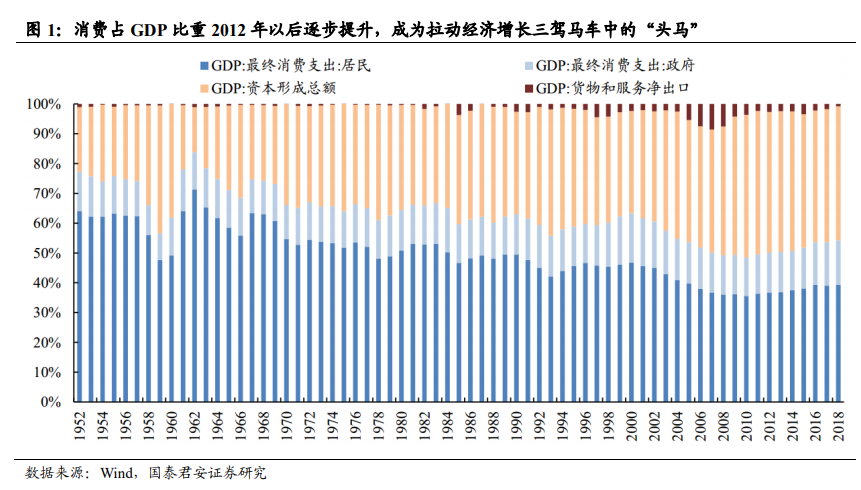

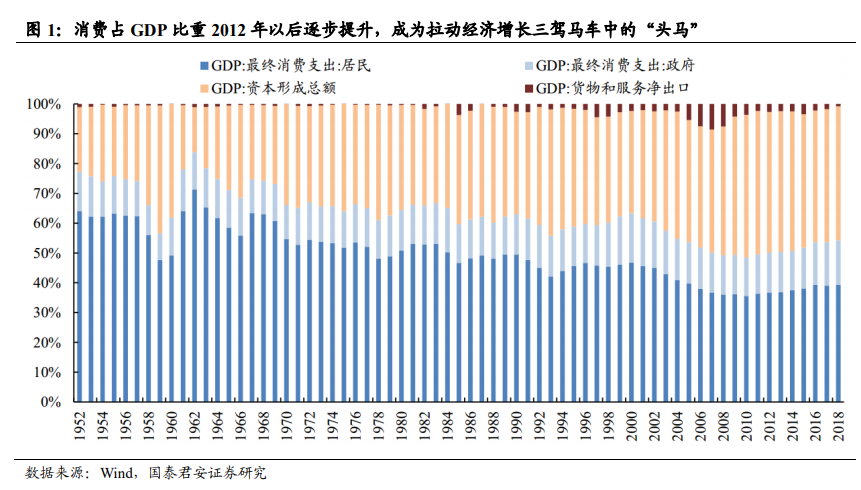

投资建议:①从宏观层面看,消费已全面上升至国家战略高度,成为经济增长核心驱动力;②经济下行压力下,预计未来整个消费增速会变得更加平稳,增长的核心驱动力逐渐从投资驱动,变为多因素共同驱动(人均可支配收入、财富分化效应、低线城市消费升级等);③2020年大消费行业的投资主线可概括为:供给看效率、需求看红利,市场热点可能会从大龙头逐步走向小龙头。我们协同九大消费行业(食品饮料、商贸零售、家电、农业、轻工、社服、汽车、纺服、传媒)分析师,精选出28只消费品小龙头企业。

目前大消费行业主要存在三大市场分歧。消费白马是否估值偏高、机构“抱团取暖”是否会瓦解、科技股崛起是否会导致消费股崩盘,目前市场担忧主要集中于这三点。我们认为,大消费行业进入下半场后,估值体系会从PE向DDM切换,以前是给“增长”估值,未来是给“竞争优势”估值,竞争优势稳固、业绩稳健增长的消费龙头估值水平是有支撑的。消费属于长周期的产业投资逻辑,如果不出现持续的业绩低于预期或者极端的外部事件,“抱团”现象很难打破,科技股的崛起并不会导致消费股崩盘,但可能会影响超额收益。

从资产配置的角度解读大消费行业。我们回顾了美国、英国、日本股市,发现大消费行业是盛产长牛股的“摇篮”,这些消费品公司不仅成功穿越了多个经济周期波动,还为投资者带来了惊人的超额回报。从资产配置角度而言,消费行业β系数更低,更受大资金青睐,无风险利率缓慢下行的大背景下更是如此。同时,MSCI第三次提升A股纳入比例,反映出海外资金“长期做多中国、加仓大消费”的信心。

九大消费行业2020年展望。A.供给看效率:伴随中国经济进入挤压式竞争时代,经营效率高、竞争优势强的龙头企业,可以挤压中小企业市场份额来获得成长;B.需求看红利:三四线城市的人口红利还在继续,这些城市人口基数大、收入增长快、边际消费倾向高,为美妆、免税、体育、休闲娱乐、户外运动、白酒、零食等细分领域带来巨大的发展机遇。在投资标的方面,我们更看好消费小龙头企业:①从增长价值角度,随着中国步入第三消费社会,个性化、品质化、多样化消费成为主旋律,众多细分领域的小龙头迎来增长提速期,而超级龙头(如白酒、家电等)市占率已经历一轮快速上行且市场预期充分;②相较于超级龙头,小龙头盈利增速更快,充分享受行业高增长红利及竞争优势加强带来的市场份额快速提升,估值性价比明显更高。

风险因素:经济增速放缓,中美经贸摩擦,行业竞争加剧的风险。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.