跌破賣出訂單

什麼是跌破賣出?

與突破買入相反,跌破賣出指投資者通過設置指定的下跌的價格或跌幅比例,當達到投資者設定的條件後自動委託下單。一般是在持有股票,股價跌破指定價位時為止蝕而定。

跌破賣出訂單目前支持美股盤前盤後交易。

操作說明

當你投資一檔股票失誤時,想要把損失限定在較小的範圍內,以避免形成更大的虧損。這時可以通過【智能落盤】-【跌破賣出】設置一定條件,及時賣出,終止損失。

讓我們來看看具體操作步驟:

STEP 1 選擇股票

選擇想要進行跌破賣出的股票,在訂單類型選擇跌破賣出。

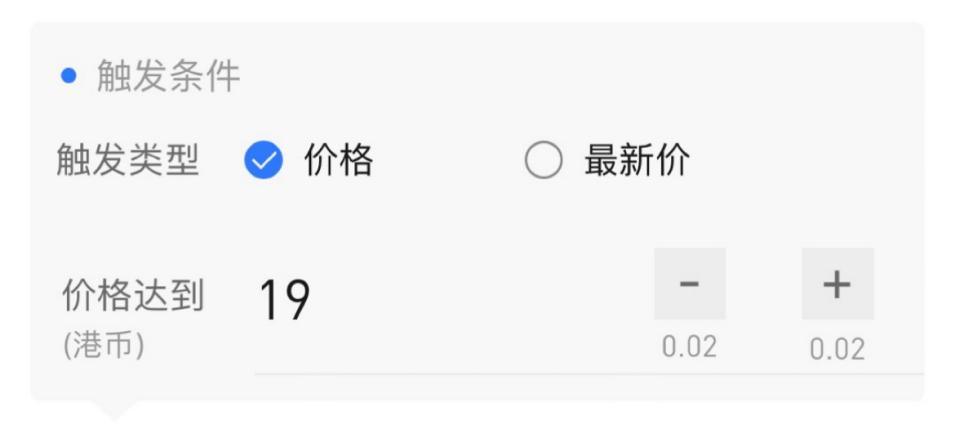

STEP 2 設置觸發條件

選擇觸發條件,可選擇價格觸發或最新價觸發,或選擇最新價按下跌幅比例設置觸發條件。一般為可承受的最大損失範圍。

選擇價格觸發時,需手動輸入價格。

選擇最新價觸發時,需填寫比例,系統將根據填寫的比例自動計算出對應股價。

根據對股票的分析,填寫適當的價格或比例,一般為可承受的最大損失範圍。當股價下跌到指定條件將觸發執行賣出方向的委託。

STEP 3 設置委託條件

輸入委託價格、委託數量。

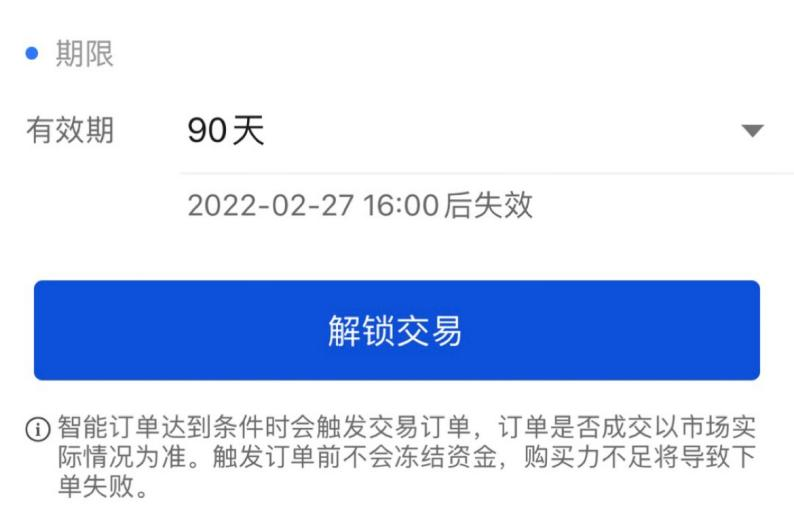

STEP 4 選擇有效期並提交訂單

選擇有效期,目前可選擇當天/2天/3天/1周/2周/30天/60天/90天,可通過改單延續有效期。

點擊解鎖交易,提交訂單。已提交的訂單可在智慧訂單頁面下查看,可以根據需要對訂單進行修改。

*若跌破賣出已經觸發,則不能進行修改,但您可以撤銷訂單重新下單。

可下單時間

任何時間

訂單有效期

目前可選擇當天/2天/3天/1周/2周/30天/60天/90天,可通過改單延續有效期。