Berkshire Hathaway will release its second-quarter report on Saturday, August 3, when it will also disclose its holdings in Apple.

Apple's holdings will be a highlight of the earnings report, along with Berkshire Hathaway's operating profit, total cash and stock repurchases.

The report will list Berkshire Hathaway's major holdings. Apple is currently its largest investment, with the current market value of its Apple shares (based on its holdings on March 31) at $172 billion. Apple shares rose 0.5% to $219.00 on Monday. Berkshire Hathaway owns about 5% of Apple and is one of the iPhone maker's largest shareholders.

(Source: uSMART)

Did Berkshire Hathaway sell more Apple shares in the second quarter?

Some investors believe Chief Executive Officer Warren Buffett, who oversees Berkshire Hathaway's roughly $400 billion investment portfolio, reduced his holdings of Apple stock again in the second quarter.

Berkshire did not immediately comment on the matter.

Buffett reduced his holdings of Apple shares by 13% in the first quarter to about 789 million shares. When asked why Berkshire Hathaway reduced its holdings of Apple shares, Buffett said it was due to tax considerations after the investment made substantial gains, and did not involve his long-term view of Apple shares. Any judgment.

Buffett has always invested in Apple not because of its technology, but because of Apple's customer stickiness. Buffett is betting on Apple's attributes that are loved by customers. He regards user loyalty as Apple's biggest moat.

However, Apple's total revenue has declined in five of the past six quarters. As Apple's performance continues to decline, Buffett's Berkshire Hathaway may face the following problems:

Is Apple's moat drying up?

Apple will announce its financial report for the third fiscal quarter of fiscal year 2024 (second quarter of the natural year 2024) after the U.S. stock market closes on August 1, Eastern Time (early morning on Friday, Beijing time). The announcement of Apple's results by then will alleviate investor doubts to a great extent.

JP Morgan predicts that Apple’s iPhone and total revenue in the second quarter are expected to exceed market expectations, laying the foundation for entering the AI-driven replacement cycle. Not only is Apple continuing its past success, but it's also actively planning for an exciting future powered by AI, which could push its stock price to new heights.

Could Berkshire Hathaway continue to reduce its holdings of Apple stock?

What suggests that Berkshire Hathaway continues to reduce its holdings of Apple stock? Here are seven factors to consider:

Increased cash: Buffett said at the shareholder meeting that the company's cash could reach US$200 billion by the end of the second quarter, compared with US$182 billion at the end of the first quarter. The additional $20 billion in cash needs to be realized through the sale of shares, and Apple is the company most likely to be significantly reduced.

Continuous reduction trend: Once Buffett starts selling stocks, he usually continues to reduce holdings. His past operations on HP, Paramount Global and bank stocks are examples.

Apple's holdings are huge: Apple accounts for more than 40% of Berkshire's stock portfolio, and it makes sense to reduce such a large holding to diversify the risk of an overly concentrated portfolio.Apple's share price has been strong: it was around $160 during the first quarter selloff, and topped $200 in the second quarter.

Value investing tendency: Buffett tends not to pay more than 15 times earnings for stocks, and Apple currently trades at 30 times expected earnings, twice what Berkshire paid when it bought it.

Shareholding expectations: Buffett said at the shareholder meeting that Apple may continue to be Berkshire's largest holding, but did not commit to maintaining the current shareholding size.

Tax factors: Buffett mentioned that the corporate tax rate may increase. Selling Apple shares will bring huge gains and require more taxes. If the Democrats win in November, the corporate tax rate may increase.

At the same time, Berkshire shareholders have many concerns about Buffett’s large investment in Apple stocks.

Challenges facing Apple: iPhone market sales are slowing down, sales in China are declining, etc. At the same time, Apple is lagging behind in the artificial intelligence race. Although Apple announced the birth of Apple Intelligence at the Worldwide Developers Conference (WWDC) on June 10, it is still lagging behind compared with other top AI companies.

Stock price problem: Apple's stock price is no longer cheap, making it difficult to find a suitable time to buy.

Antitrust investigation: Many European and American countries have launched antitrust investigations against Apple. If it is found to have violated the rules, it may face high fines and major changes in its business model, which will affect its revenue.

Challenges to the dominance of technology companies: It is difficult for technology companies to maintain their dominance in the long term, and Apple’s existing products may be replaced in fifteen years.

Lack of physical assets: Apple lacks physical assets as a safety cushion, and the risk is high, which is not in line with Buffett's usual investment style.

Is it okay to invest in Apple now?

Wall Street currently believes that Apple’s second quarter GAAP revenue is expected to be US$84.48 billion, a year-on-year increase of 3.3%. Considering Apple has suffered revenue declines in five of the past six quarters, this increase is certainly a positive sign.

Wall Street also expects Apple to post adjusted earnings per share of $1.35 in the second quarter, a year-on-year increase of 7.4%, much higher than the 0.7% in the first quarter. As Apple's largest source of revenue, iPhone sales were 38.95 billion yuan, a year-on-year decrease of 1.8%. The decline was significantly narrower than the first quarter (a year-on-year decrease of 10.5%).

JP Morgan predicts that Apple’s iPhone and total revenue in the second quarter are expected to exceed market expectations, laying the foundation for entering the AI-driven replacement cycle. Not only is Apple continuing its past success, but it's also actively planning for an exciting future powered by AI, which could push its stock price to new heights.

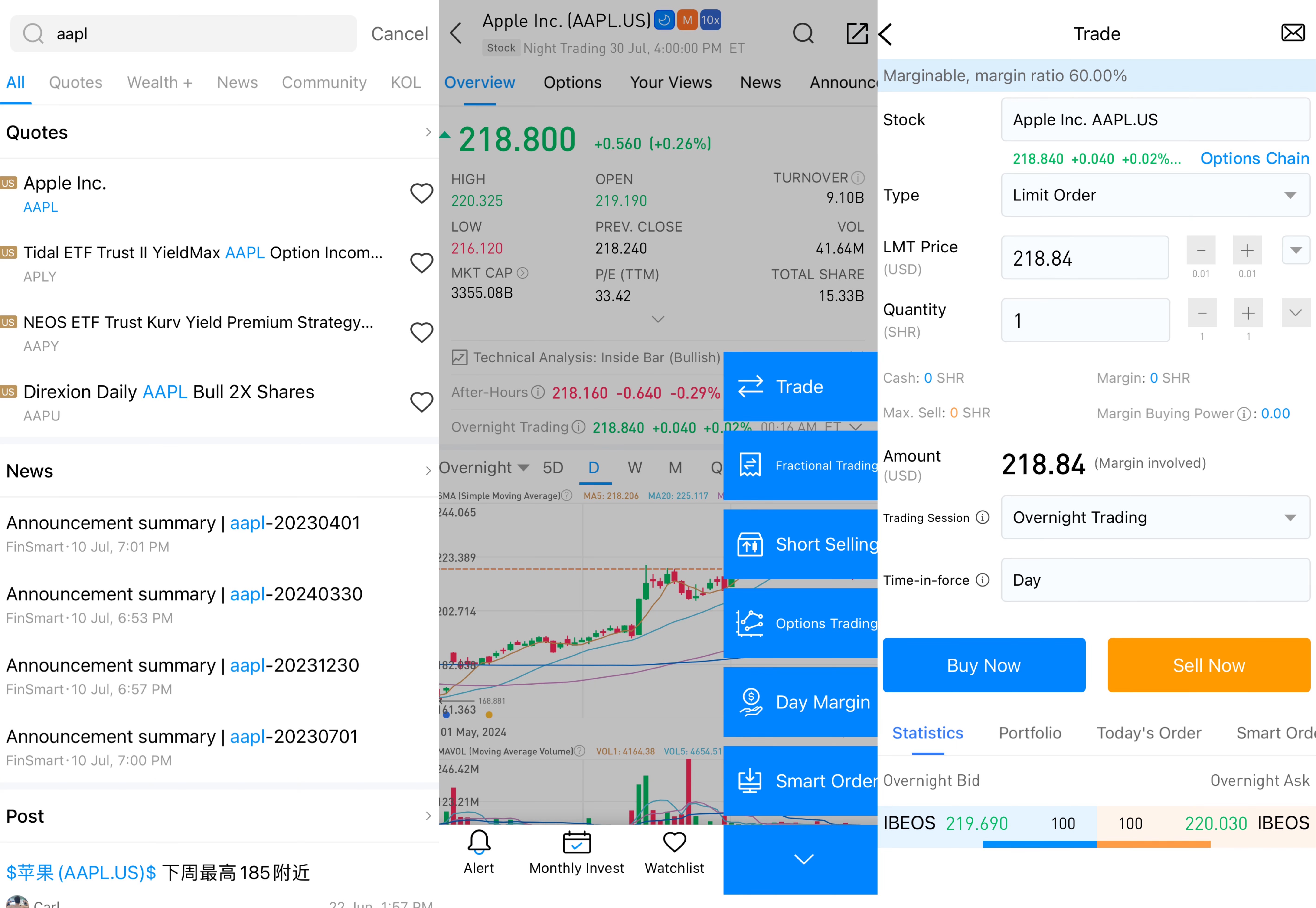

How to invest in Apple on uSMART?

After logging in to uSMART HK APP, click "Search" from the upper right corner of the page, enter "AAPL" or "Apple", you can enter the details page to learn about transaction details and historical trends, click "Trade" in the lower right corner, and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows: