期權大單 | 拜登重申,美國不會出現債務違約

uSMART盈立智投 05-18 15:55

市場概覽 (5月17日)

美股週三收高,三大指數均漲超1%,地區性銀行股普漲。投資者期待白宮與美國國會就債務上限問題進行的談判能取得進展,以避免出現災難性的違約。拜登重申,美國不會出現債務違約。

週三美股期權市場總成交量41,591,813張合約。其中,看漲期權佔比52%,看跌期權佔比48%。

消息面上,美國總統拜登週三說,有信心就預算達成一致;而共和黨衆議院領袖麥卡錫則表示對拜登的談判意願感到鼓舞。也就是說,雙方仍然沒有找到答案。

所以,幾乎可以肯定的是,債務上限的“X日”將在6月初到來。美國財長耶倫認爲X日是6月1日,彭博分析師估計最早可能是6月5日,德銀、巴克萊均認爲債務上限將在6月初觸發。

在當前背景下,美銀認爲,大多資產仍沒表現出畏懼情緒,很可能在危機關頭“跳崖式大跌”。

買期權可避險?

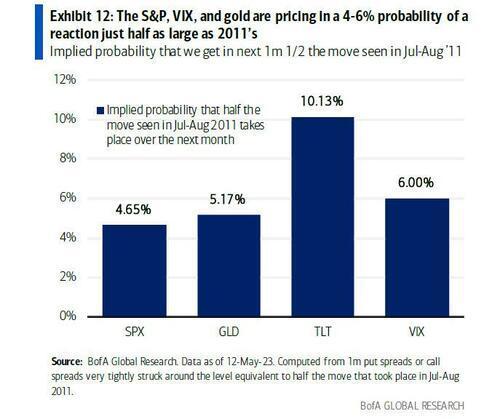

通過對比期權價格,美銀髮現,標普500指數、波動率指數(VIX)和黃金定價暗示發生類似2011年危機的概率爲4-6%,僅爲當年危機爆發前兩個月的一半。

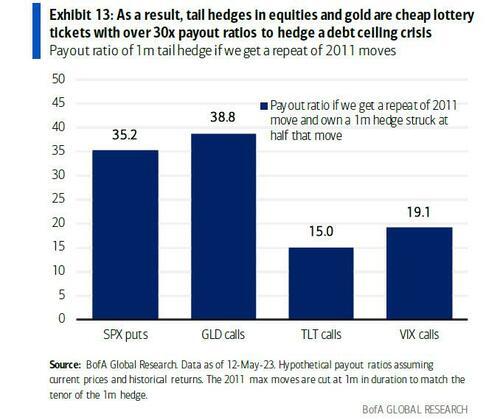

基於不同資產的反應,美銀評估各種對衝策略在2011年危機重演時的表現,結果發現:

以當前價格購買的100萬套期保值產品的支付比率爲2011年的一半。例如,如果標普指數在下個月下跌17% ,就像2011年7月-8月那樣,標普指數100萬套期保值產品的支付比率爲8.5%。因此,現在買進標普500指數期權的回報率仍爲35倍。

買進黃金期權的回報率爲39倍,波動率指數期權的回報率爲19倍。另外,長期美債暗示發生這種衝擊的概率比之前高出兩倍,達到10%。因此買進iShares 20+年期國債ETF可能獲得15倍的回報。

美銀表示,對股票和黃金進行尾部對衝相當於購買“廉價彩票”,可以獲得超過30倍的回報率,對衝債務上限危機。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.