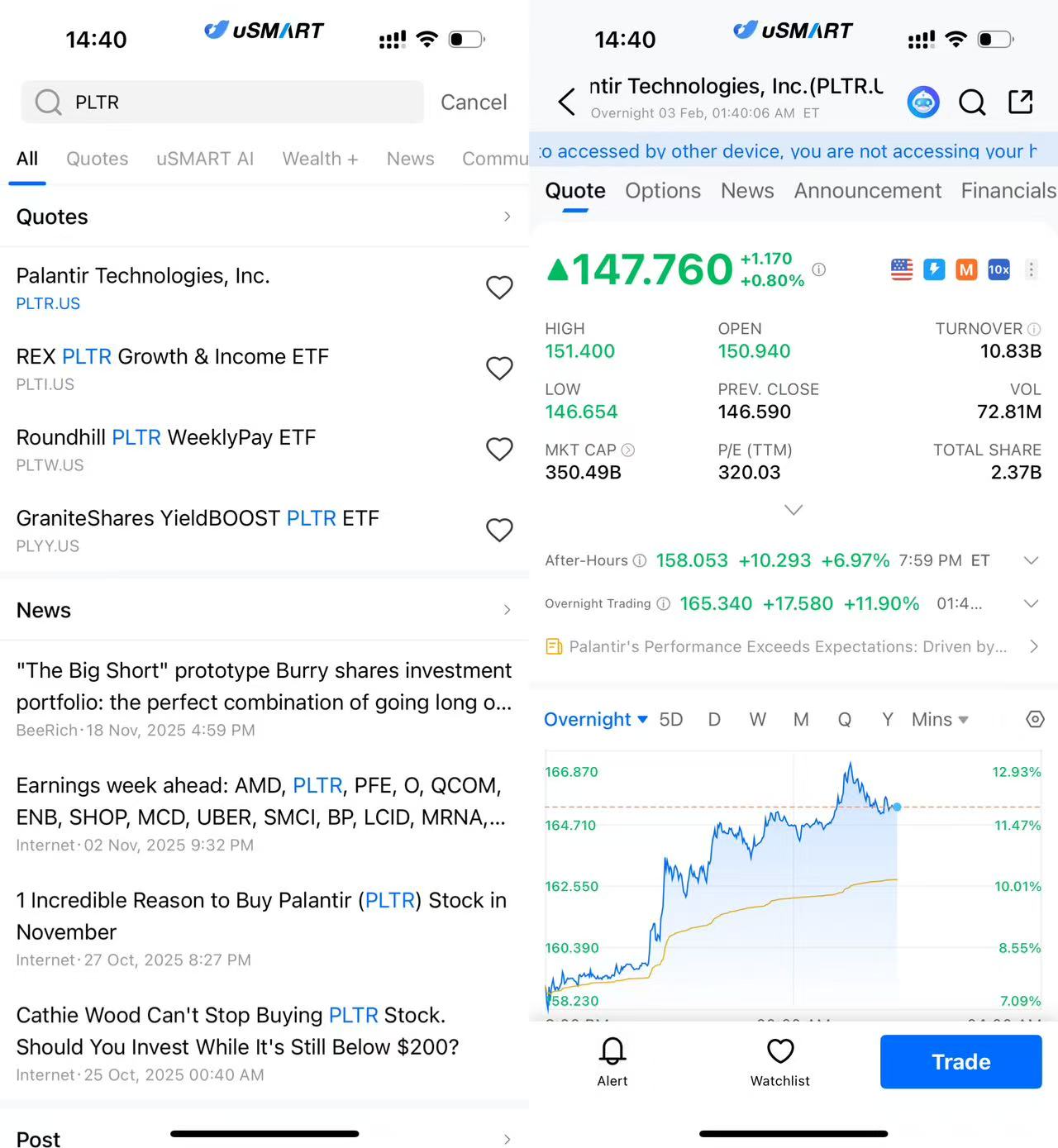

After the release of its Q4 2025 financial results, Palantir (PLTR) saw strong performance in after-hours trading, with its stock closing up $1.17 at $147.76, a gain of 0.80%. The reported results exceeded market expectations, showcasing a strong growth momentum.

(Image source: uSMART HK App)

Strong Revenue Growth and Outperformance

Palantir's total revenue for Q4 2025 reached $1.407 billion, a significant 70% year-over-year increase and a 19% sequential growth. Revenue from the U.S. market performed particularly well, reaching $1.076 billion, a 93% year-over-year growth and a 22% sequential growth. This growth reflects the strong demand for Palantir in its domestic market. U.S. commercial revenue surged by 137% year-over-year and 28% sequentially, hitting $507 million. Meanwhile, U.S. government revenue also showed robust growth, reaching $570 million, a 66% year-over-year increase and a 17% sequential growth.

Strong Profitability and Cash Flow

On the profit side, Palantir's GAAP net income for Q4 2025 amounted to $609 million, with a profit margin of 43%. Adjusted free cash flow reached $791 million, with adjusted earnings per share (EPS) at $0.25. Operating cash flow stood at $777 million, with a remarkable 55% profit margin. These financial metrics highlight Palantir's strong profitability and cash flow generation capabilities, laying a solid foundation for future investments and expansion.

Growth in Large-Scale Transactions and Expanded Client Depth

In Q4 2025, Palantir completed 180 transactions globally, each worth at least $1 million. Among these, 84 transactions exceeded $5 million, and 61 transactions surpassed $10 million. These transactions indicate that Palantir not only achieved breakthroughs in volume but also continued to solidify its market leadership in the large-scale transaction segment.

Outlook for 2026: Continued Strong Momentum

For 2026, Palantir is confident in its growth prospects, projecting Q1 2026 revenue to range between $1.532 billion and $1.536 billion, with full-year revenue expected to be between $7.182 billion and $7.198 billion. Particularly, U.S. commercial revenue is expected to grow by at least 115%, surpassing $3.144 billion. Meanwhile, adjusted operating income is anticipated to be between $4.126 billion and $4.142 billion. These projections indicate strong growth momentum in the coming months and throughout the year, especially with continued expansion in both the commercial and government sectors. With the strong performance in Q4 2025, Palantir's leadership position in the data analytics field has been further cemented. With healthy cash flow, profitability, and an expanding customer base, Palantir's future outlook remains promising, continuing to attract the attention of the market and investors.

How to Buy Palantir via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (PLTR.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)