At 10 a.m. EST on Friday, August 23, Federal Reserve Chairman Powell delivered a speech at the Jackson Hole Annual Meeting of Global Central Banks on the issue of interest rate cuts. Powell stated that the Federal Reserve "will do its best to support a strong labor market while further achieving price stability," and it is clearly stated that interest rate cuts are the future policy direction.

After Powell's speech, U.S. Treasury bond prices rose and U.S. Treasury yields of all maturities fell, with the benchmark 10-year U.S. Treasury yield closing at 3.8% on the day, down 8 basis points last week. U.S. government bonds yielded 1.44% this month, according to Bloomberg indices.

As the wave of interest rate cuts gradually comes into play, the interest rates of time deposits are bound to drop step by step, making them less attractive. For investors looking for low-risk investment tools that can also provide stable returns during interest rate cuts, U.S. bonds are an ideal choice that can effectively diversify investment risks.

Investing in U.S. bond ETFs is the most convenient way to invest in U.S. bonds. Investing in U.S. bond ETFs simplifies the purchase and management process of U.S. bonds. Through U.S. Treasury ETFs, investors do not need to separately purchase and hold multiple U.S. Treasury bonds of different maturities. Instead, they can easily own a basket of U.S. Treasury bonds by purchasing one ETF, covering U.S. Treasury bonds of different maturities and categories. This article focuses on introducing U.S. bond ETFs so that investors can prepare themselves for a new round of global interest rate cut cycles.

What are U.S. Treasury ETFs?

U.S. Treasury ETFs (U.S. Treasury ETFs) are exchange-traded open-end index funds with U.S. debt as the underlying asset. It provides a simple and low-cost method by combining a variety of U.S. debt securities. A lower approach that allows investors to participate in the U.S. Treasury market. U.S. bond ETFs reflect changes in prices and returns of U.S. Treasury bonds by tracking specific U.S. bond indexes, allowing investors to indirectly hold a basket of U.S. bonds while enjoying the liquidity and risk diversification advantages of ETFs.

U.S. Treasury bonds are among the most liquid and creditworthy bonds in the world and are considered risk-free assets due to the credit guarantee of the U.S. government. Therefore, U.S. bond ETFs have become an important tool for many investors in their diversified investment portfolios due to their low risk and stable returns.

The entry threshold for U.S. bonds is low, and it is as convenient and highly liquid as stock trading. Investors can buy and sell at any time, and it can effectively diversify the risks of a single bond. Compared with U.S. bonds, U.S. bond ETFs cannot freely select designated bonds and have management fees. The actual performance may differ from the actual index due to market fluctuations.

What kind of investors are U.S. bond ETFs suitable for?

U.S. Treasury ETFs are suitable for investors who seek stable income and have a low risk tolerance.

●Conservative investors: For those investors who are unwilling to bear the risk of high volatility in the stock market, U.S. bond ETFs provide relatively stable returns.

●Retirement investors: Retirees or investors approaching retirement may choose U.S. bond ETFs to obtain stable interest income to protect their living expenses.

●Investors with diversified needs: Investors can achieve asset allocation and diversify investment risks by including U.S. bond ETFs in their investment portfolios.

Advantages of U.S. Bond ETFs

●Low risk: U.S. bond ETFs mainly invest in U.S. government bonds. These bonds are widely considered to be risk-free assets because they are backed by the U.S. government and have an extremely low possibility of default.

●High liquidity: Due to the large size and strong liquidity of the U.S. Treasury market, U.S. bond ETFs are very actively traded and investors can easily buy and sell.

●Stable income: The yield of U.S. bond ETFs is usually directly related to market interest rates. Although the yield is low, it has high stability and is suitable for long-term holding.

●Low management fees: Compared to actively managed funds, U.S. bond ETFs generally have lower management fees because they simply track a bond index.

Risks of U.S. Treasury ETFs

●Interest rate risk: When market interest rates rise, the price of U.S. Treasury bond ETFs will usually fall. In particular, long-term Treasury bond ETFs are more susceptible to changes in interest rates.

●Inflation risk: Although U.S. Treasury bonds are considered safe investments, inflation may erode the bonds' real yields, leading to a decrease in purchasing power.

●Credit risk: Although the credit risk of U.S. debt is extremely low, the possibility of a default by the U.S. government in extreme circumstances cannot be ruled out, although this situation is extremely rare.

How to choose a U.S. Treasury ETF?

When choosing the right U.S. Treasury ETF, investors need to consider the following:

●Term structure: The term structure of the bonds in the U.S. bond ETF portfolio is very important. Short-term bonds are relatively stable, while long-term bonds are more sensitive to changes in interest rates. If you are looking for stable returns and reduced risk, you should consider short-term U.S. bond ETFs; if you can bear higher risks in exchange for higher potential returns, you can consider mid-term or long-term U.S. bond ETFs.

●Expense ratio: Although the fees of U.S. bond ETFs are generally low, investors still need to pay attention to the expense ratio, because the difference in management fees in long-term investment may have a greater impact on returns.

●Historical performance: Although past performance does not necessarily represent the future, analyzing the historical performance and volatility of ETFs can provide a reference for investment decisions.

●Asset size and liquidity: Choose U.S. bond ETFs with larger asset sizes and higher trading volumes. The spreads of such ETFs are usually smaller and transaction costs are relatively low.

Major U.S. Treasury ETFs

●iShares 20+ Year Treasury Bond ETF (TLT): focuses on long-term U.S. Treasury bonds with an investment period of more than 20 years. It is suitable for investors with higher risk tolerance and who want to obtain higher interest rates.

●iShares 7-10 Year Treasury Bond ETF (IEF): Invests in medium-term Treasury bonds with maturities of 7 to 10 years, with low risk and suitable for investors seeking stable returns.

●SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL): Invests in short-term Treasury bonds (1-3 months), which is almost unaffected by changes in interest rates and is very suitable for extremely conservative investors.

●Vanguard Short-Term Treasury ETF (VGSH): Focuses on short-term Treasury bonds with maturities of 1 to 3 years, providing low risk and moderate yields.

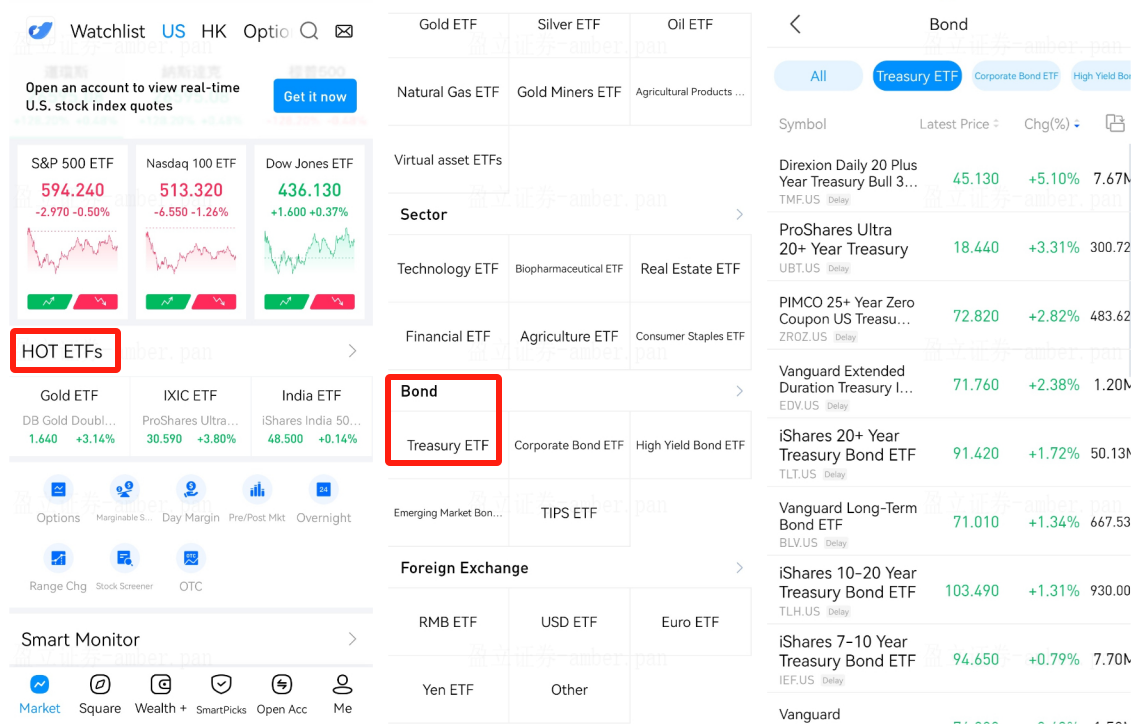

How to trade U.S. Bond ETFs on uSMART HK:

After logging into uSMART HK APP, click "US" from the top of the page, then click "Hot ETFs", find and click "Treasury Bond ETFs" in "Bond Types" to find the U.S. bond ETFs that can be invested, click on the one you want to invest in. If you want to invest in a U.S. bond ETF, you can initiate a transaction order and the transaction can be completed. The picture guide is as follows:

This picture is for illustrative purposes only