全球股市漲幅喜人,多個板塊上漲5%

uSMART盈立智投 07-09 17:30

全球市場週迴顧

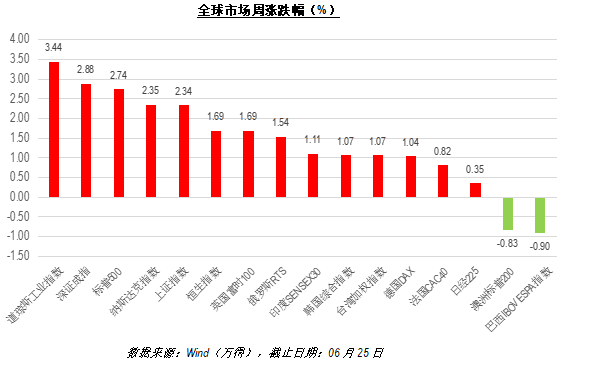

上週,全球市場普漲,美國地區領漲,道瓊斯工業指數漲幅爲3.44%。

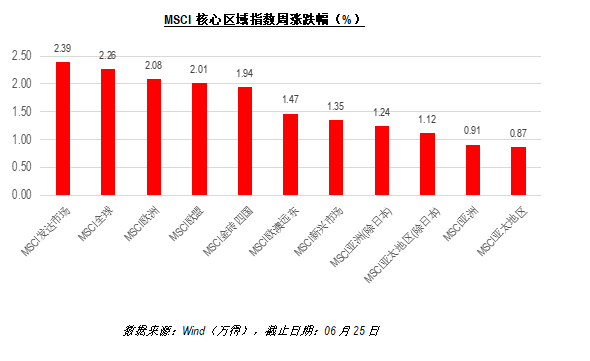

全球核心區域指數亦全線飄紅,其中發達市場領漲。

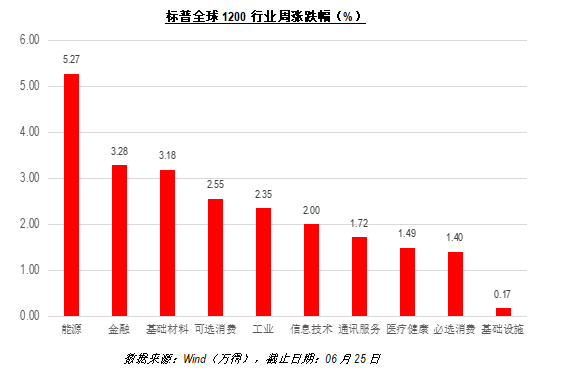

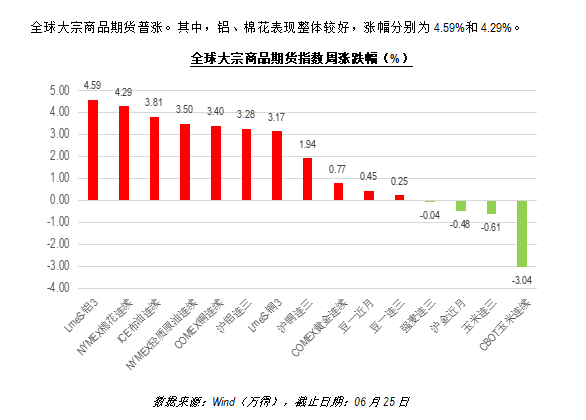

標普全球各行業皆漲。其中,能源板塊漲幅高達5.27%,漲勢喜人。

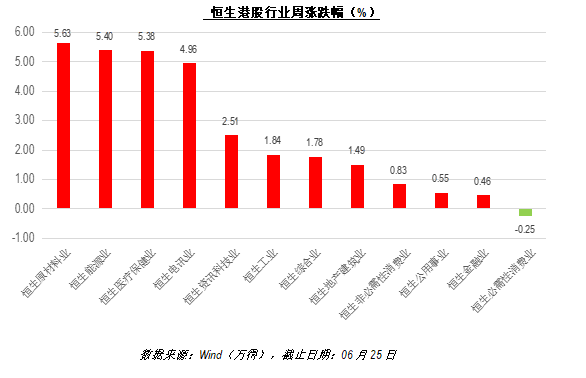

上週,港股板塊全線上升,其中原材料、能源、醫療保健板塊表現亮眼,漲幅均超5%。

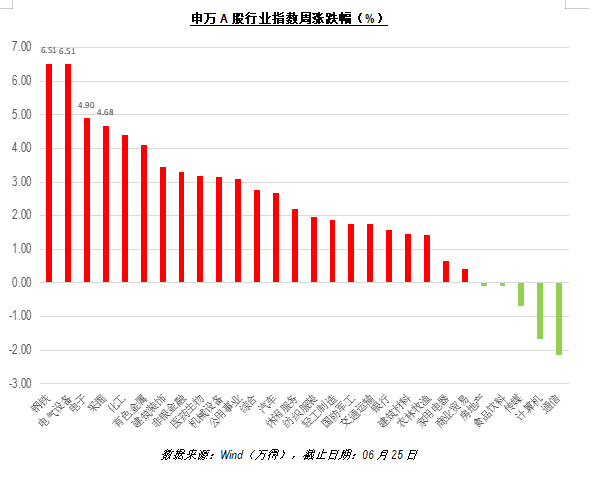

上週,申萬一級行業漲幅喜人。其中,鋼鐵、電器設備領漲,漲幅都高達6.51%。

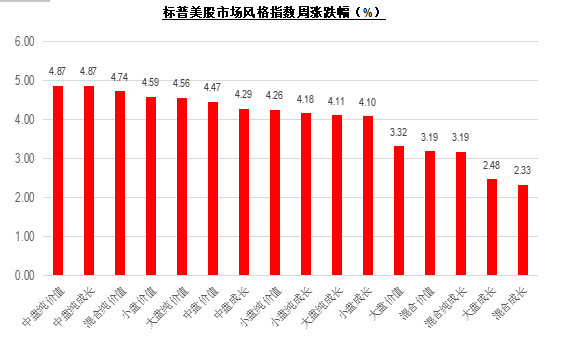

上週,標普美股市場風格指數集體上漲。其中,價值風格領漲,超過半數風格指數漲幅高於4%。

全球基金投資者動態

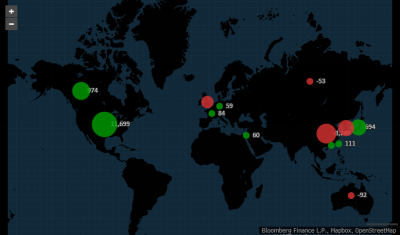

上週,美國、歐洲、及日本地區獲最大淨流入。

數據來源:彭博,截止日期:06月25日

大類資產方面,大盤股票ETF最受投資者青睞。固定收益ETF方面,投資者信用偏好下沉,信用等級在BBB及以上的信用債獲得最大淨流入。策略方面,成長型ETF、全市場債基金以及企業債券基金受投資者青睞。貨幣基金規模持續呈淨流出狀態。

整體來看,上週投資者的股票投資情緒較高。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.