2020年营收略不及预期,21年持续回暖,金沙中国年报点评

3月25日,金沙中国(1928.HK)发布了2020年度业绩公告。

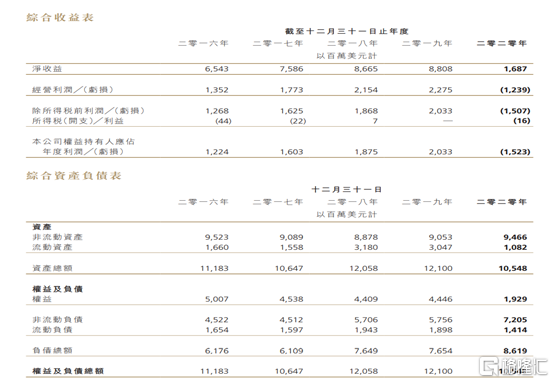

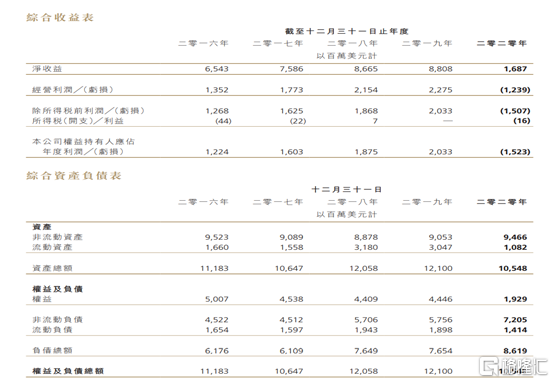

公司2020年全年营收同比下降80.8%至营收16.87亿美元,净亏损15.2亿美元,同比下降90.28%。其中20Q4经调整物业EBITDA为0.47亿美元,相较19年同期的8.11亿美元和三季度的亏损2.33亿美元,其业绩略低于预期,受该消息影响,公司股价小幅下跌约1%。

金沙中国财务摘要

资料来源:公司公告

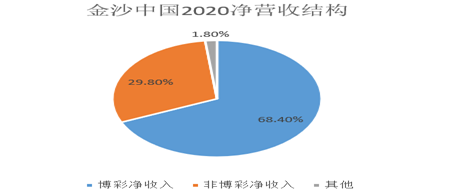

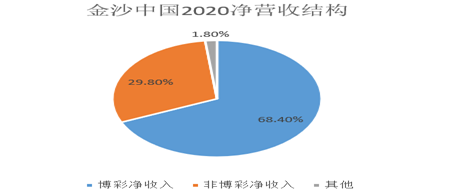

业绩分拆来看,金沙中国2020年受疫情影响较大,由于签证与旅游限制的缘故,2020年访澳门人数大跌,博彩与旅游是相辅相成的,因此公司2020年博彩净收入下降至11.69亿美元,比重下降到68.4%,非博彩净收入则为5.1亿美元,比重抬升至29.8%。伴随着疫情复苏以及禁令的放开,这个比重会进一步提升。

资料来源:WIND

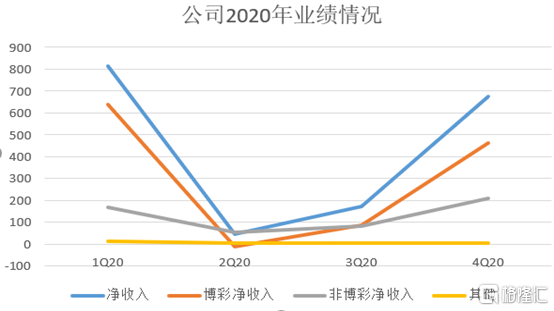

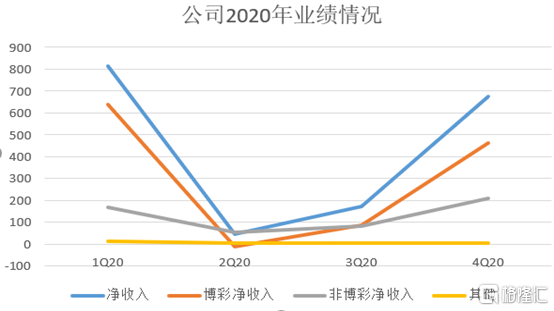

将四个季度分拆来看,考虑到澳门地区是全国疫情控制最好的地区,已经有一年没有本土新增,2020Q2以后公司营收开始缓慢回升,20Q4则复苏速率大大提升。预计近年全年有望恢复至疫情前60%以上的数据。

资料来源:WIND

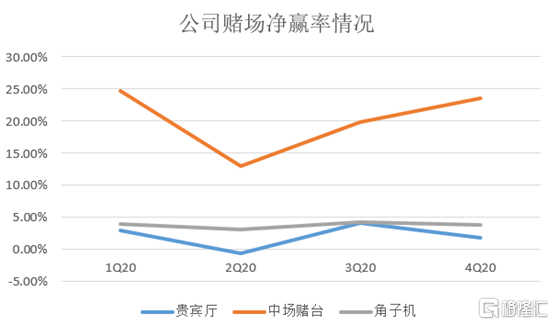

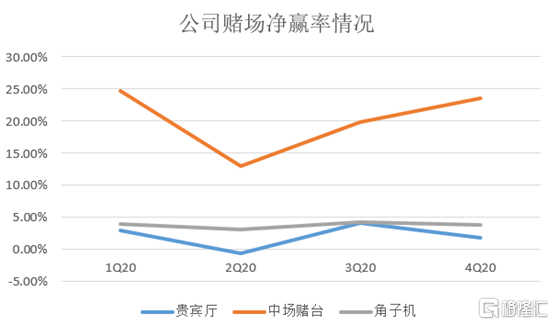

将博彩业务分拆来看,受疫情影响最大的板块是贵宾厅业务,其净赢率大幅下降,疫情前贵宾厅净赢率平均水平维持在3.3%-3.4%,20年平均水平为2.36%,因贵宾赢率较低,标准化赢率下经调整物业EBITDA增加0.23亿美元至0.7亿美元。新冠疫情导致去年2月5日-26日期间部分博彩业务暂停,客房业务在二月和三月期间也曾暂停。按业务来看,四季度博彩/客房/餐饮同比下滑74%/65%/68%,中场业务和贵宾业务均录得超过70%的跌幅,贵宾业务收入大约只有19年的一成,其受影响最深。

高端中场和商场分部提振业绩。12月酒店入住率达到50%,但因客流仍未恢复到疫情前水平,中场表现持续低迷。四季度在高端中场业务和奢侈品零售业务提振下业绩开始恢复,高端中场赢额约为19年同期44%,而普通中场赢额仅为24%。角子机方面的话基本保持稳定,主要受人数大幅下降的影响,后期会回到疫情前水平。

在公司增长点方面,底层逻辑是得益于疫情复苏后禁令的陆续解禁,另外金沙中国旗下项目,“澳门伦敦人”将会在今年 2月8日首阶段开放,原本预计20H1开业,受疫情影响延期;开放设施包括供应 600 间全套房的澳门伦敦人酒店、水晶金殿、全新餐厅及互动式伦敦主题景点,而整个项目预计于 2021 年分阶段完成。可以预计今年上半年澳门博彩业在疫情反复的阴霾下仍处于一个低流量的复苏态势,短期来看原有酒店项目并不能满员,新项目开业更多是对公司长远发展的影响。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.