A股收评:三大指数集体收跌,创业板指大跌近5%!抱团股掀跌停潮,逾3000股飘绿

今日,三大指数早盘一度走高,但随后单边下行,创业板指盘中最大跌逾5%。截至收盘,沪指跌2.30%,收报3421.41点,深证成指跌3.81%,收报13863.81点;创业板指跌4.98%,收报2728.84点,两市成交量较前一交易日有所放大,合计成交9792.87亿元左右。题材板块多数走弱,白酒、军工、农业板块大跌,油气、核电、电力板块相对活跃,下跌个股增至3000余家,炸板率持续走高,市场氛围差。

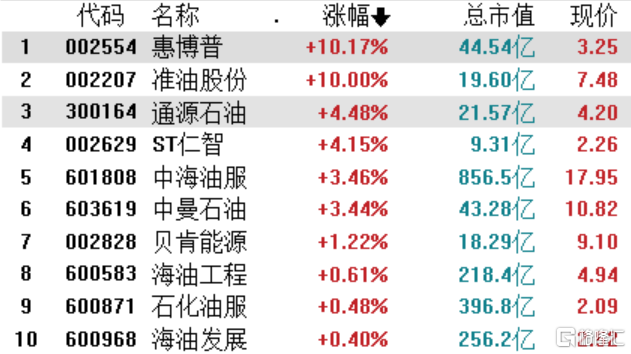

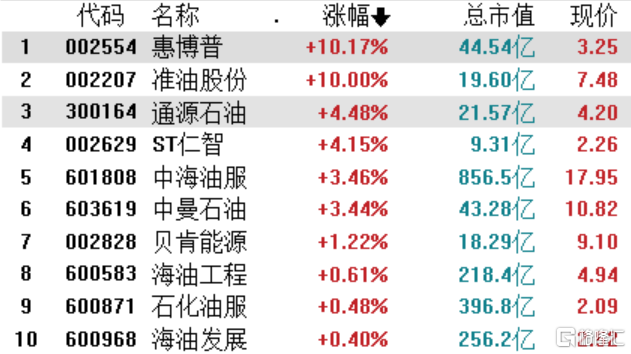

盘面上,权重股再度集体大跌,同花顺漂亮100指数跌逾4%,贵州茅台跌逾4%,比亚迪跌停,宁德时代跌5%,抱团风向标白酒概念跌幅居前,泸州老窖、山西汾酒跌停;国防军工板块持续下行领跌两市,航发动力、中航沈飞、中航西飞、洪都航空等近十股先后跌停;受益于国际油价上涨,油气采掘板块整体维持强势,惠博普、准油股份涨停。

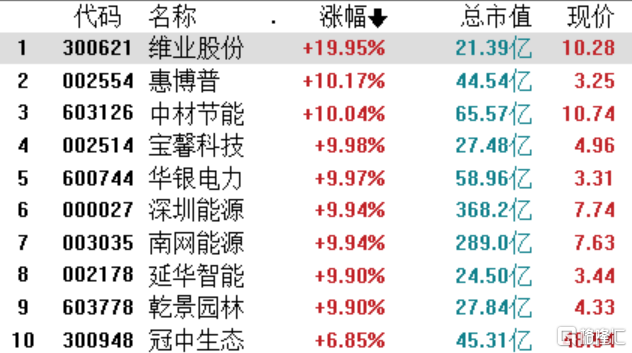

具体来看,电力板块领涨。中闽能源涨停、华银电力、深圳能源、南网能源跌超9%。吉电股份涨超7%,深南电A、节能风电等涨超6%。

油气采掘板块持续强势,惠博普、淮油股份涨超10%,同源石油、中海油服、中曼石油涨超3%,其余个股跟涨。消息面上,国际油价持续上涨,创14个月以来新高。上周OPEC+延续减产计划叠加沙特被袭,为高油价提供一定支撑。

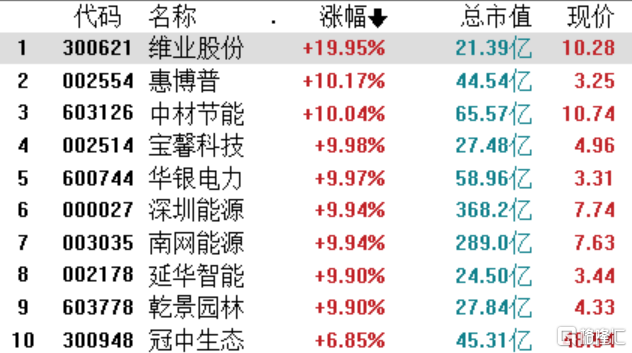

核电板块强势崛起,南风股份、中电环保涨超10%,兰石重装、中盐化工、方大炭素等涨停,中国核建、太原重工等涨超9%。消息面上,政府工作报告指出,推动煤炭清洁高效利用,大力发展新能源,在确保安全的前提下积极有序发展核电。

碳中和概念持续上涨,伟业股份涨进20%,惠博普、中材节能涨超10%,宝馨科技、华银电力、深圳能源等多股涨超9%。

今日白酒概念再遭重挫,泸州老窖,山西汾酒跌停,古井贡酒、五粮液、青海春天跌逾8%,金徽酒、老白干酒、酒鬼酒等跌超6%。

国防军工大跌,航发控制、中航沈飞、航发动力、中航西飞等跌停。航天电器、中航重机。新余国科等跌逾9%。

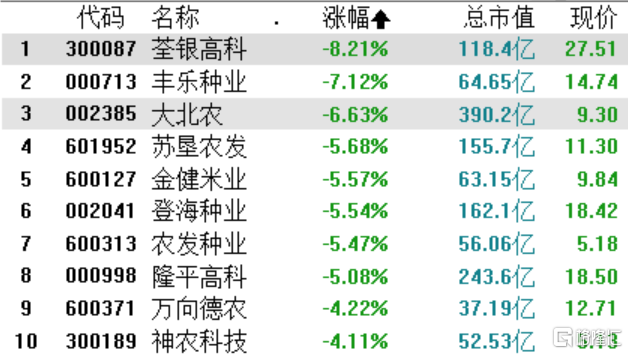

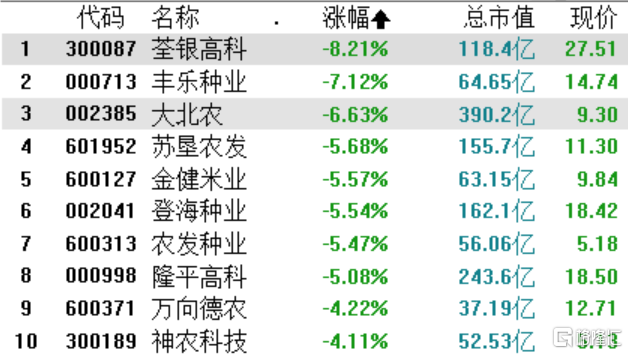

玉米板块飘绿,全银高科跌逾8%,丰乐种业跌7.12%,大北农、苏垦农发等跌超5%。

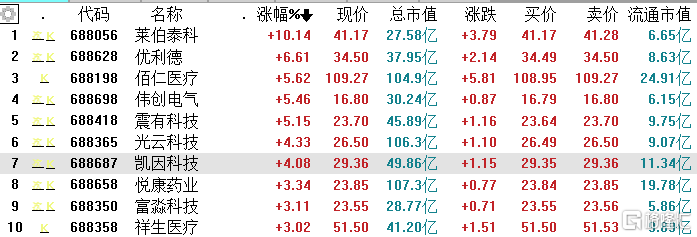

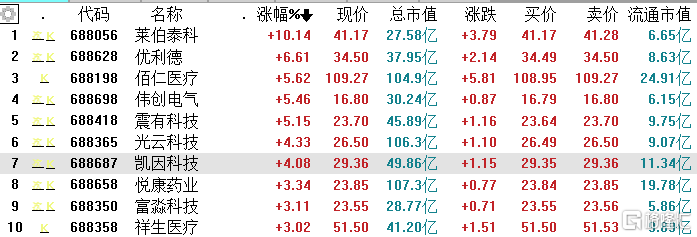

科创板方面,莱伯泰科领涨,涨幅超10%,优利德涨超6%,佰仁医疗涨超5%。

跌幅前三的企业分别为极米科技,大跌16.39%,睿创微纳大跌14%,奥普特跌逾13%。

主力资金方面,电力、保险及其他和光学光电子为主力净流入排名前三的行业。

电气设备、饮料制造及证券为主力净流出排名前三的行业。

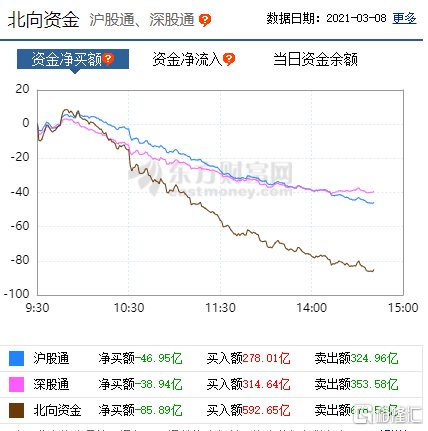

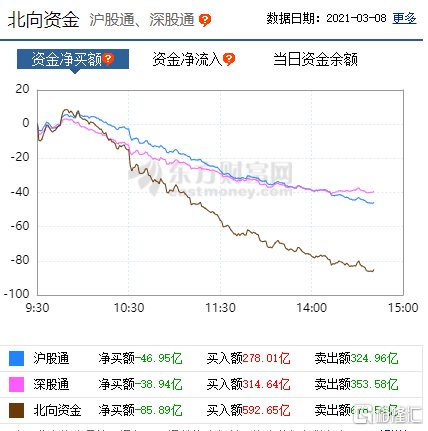

统计数据显示,北向资金合计净流出85.89亿元。其中沪股通净流出46.95亿元,深股通净流出38.94亿元。

民生证券表示,由于年后的跌幅明显,后续散户依靠基金入市的行为会谨慎很多,从增量资金接力的角度,市场的风险偏好会下移一个台阶,因此各板块的估值扩张会告一段落,盈利将成为下一阶段确定性的来源。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.