满屏绿!白酒再遭血洗,茅台蒸发1300亿,泸州老窖罕见跌停!宁德比亚迪齐齐暴跌蒸发1000亿!港股跳水2%,港交所一度暴跌9%!

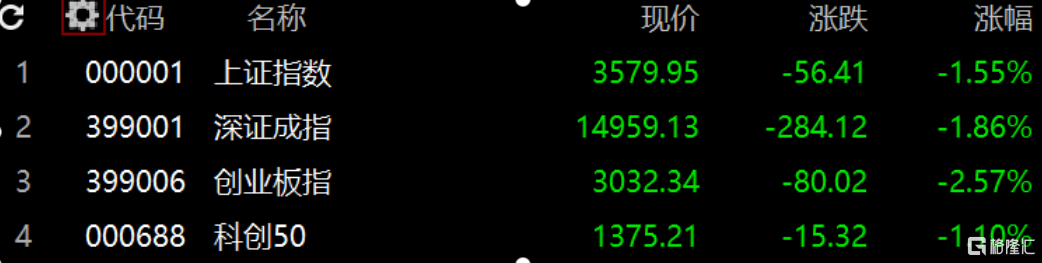

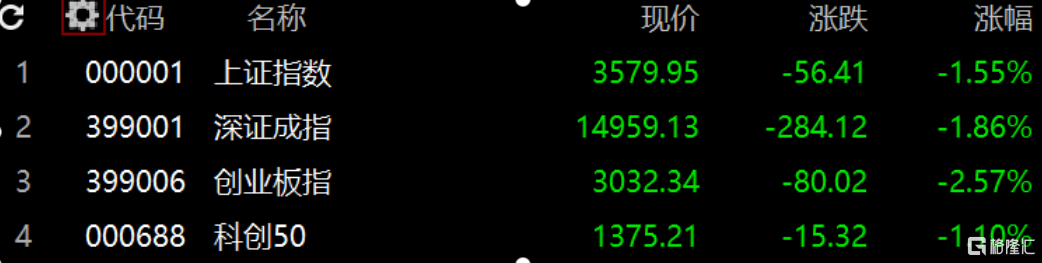

今日,A股三大指数集体暴跌,沪指跌超1.5%,失守3600点,深成指大跌1.86%,报14959.13点,创业板指大跌2.57%,报3032.34点。

盘面上,抱团股集体大跌,白酒股再遭血洗,新能源板块领跌,稀土、有色板块分化回调。半导体芯片板块逆势上涨,科技总体表现回暖。临近午盘,指数一度小幅回升。白酒股跌幅小幅收窄,另一方面,半导体等活跃题材概念涨幅也有所回落。

具体来看,白酒板块杀跌,泸州老窖跳水逼近跌停,山西汾酒跌超8.6%,酒鬼酒跌超7%,五粮液、青青稞酒、金种子酒跌逾5%,贵州茅台盘中一度失守2200元大关,现跌超4.2%。

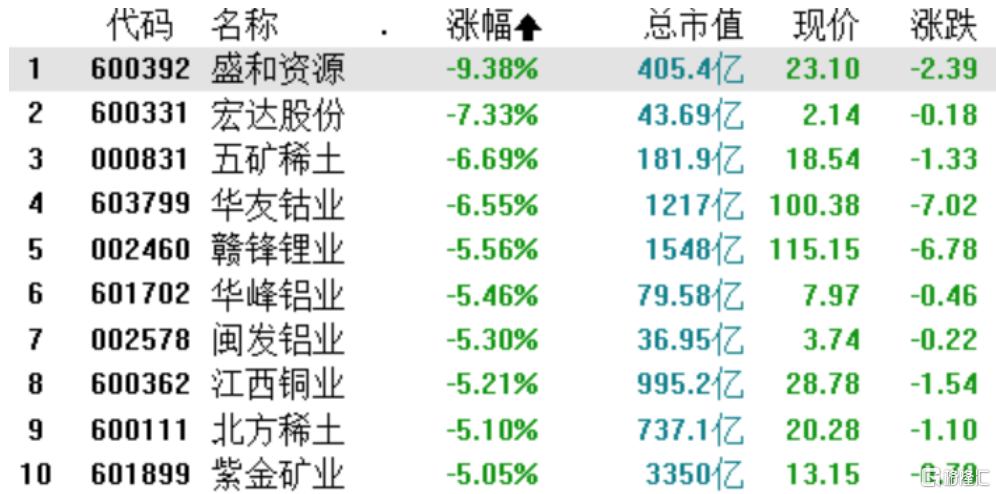

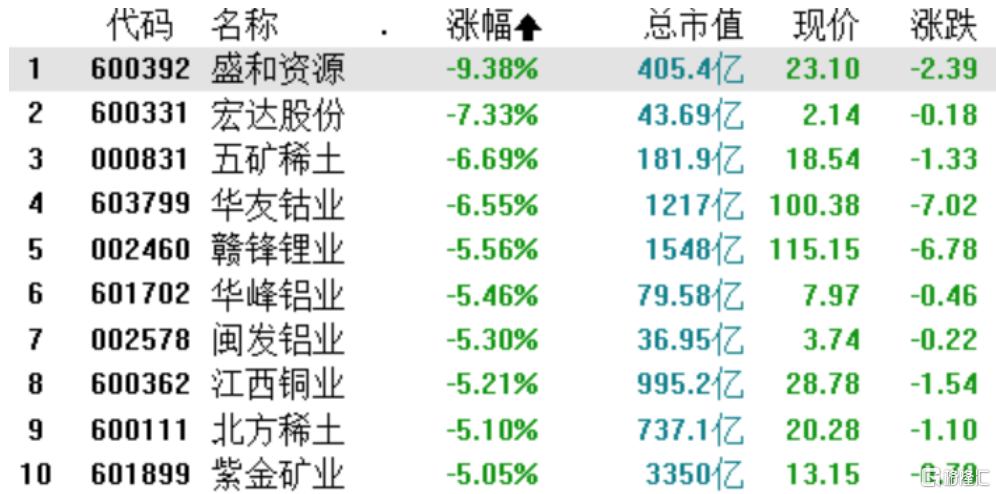

近日强势上涨的有色金属板块熄火,盛和资源封跌停,赣锋锂业、华峰铝业、江西铜业、华友钴业、天山铝业等纷纷大幅杀跌。

此外,新能源板块也跌幅居前,宁德时代跌超7%,蒸发近600亿市值,比亚迪、长城汽车均跌超5%。

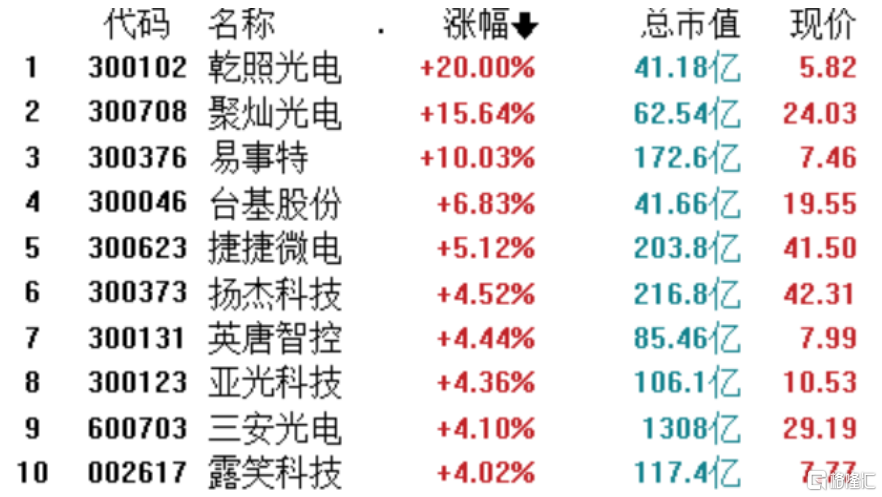

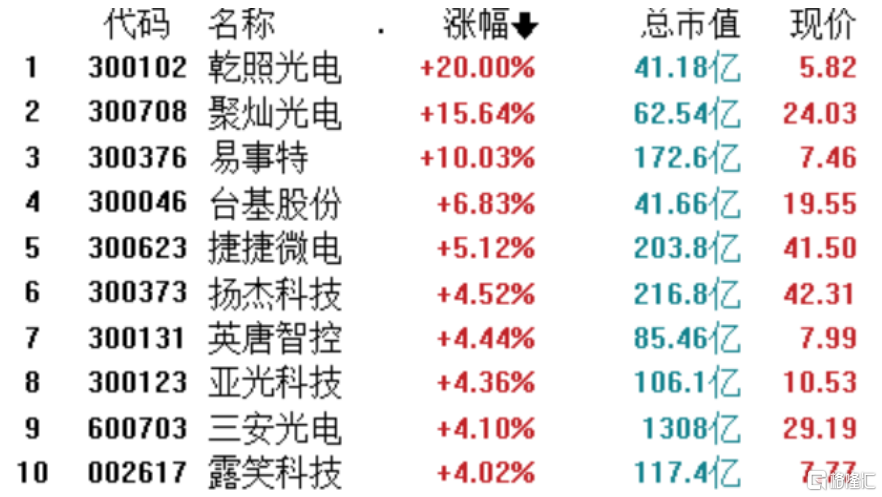

半导体板块今日逆势上涨,乾照光电涨停,聚灿光电大涨15.64%,台基股份、捷捷微电扬杰科技等多股表现强势。东吴证券表示,在半导体产品供需紧张状态加剧和景气度持续提升的情况下,国内相关的半导体设计公司若已拥有具备市场竞争力的产品,并且产能配置充足,则有望加速客户认证、承接更多订单或提升议价能力和盈利水平,充分受益于下游高涨的应用需求。

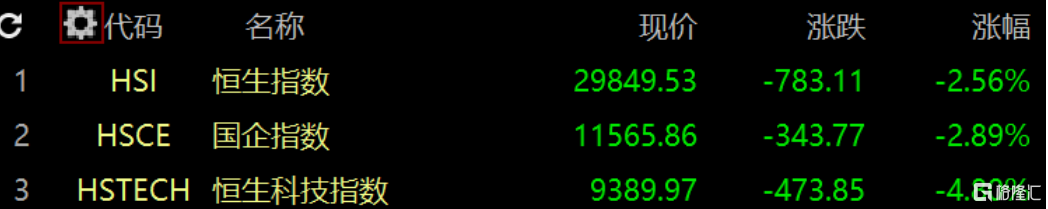

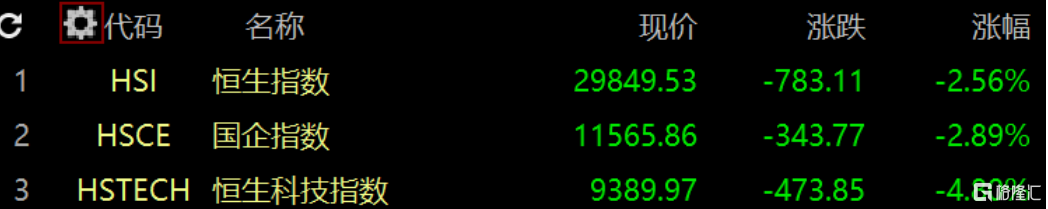

港股方面,今日高开低走。截至午盘,恒生科技指数跌超3.5%,恒指跌1.92%,报30044点。盘面上看,光伏、稀土、油气板块跌幅居前,有色、大型科网股大幅走低,医药、锂电池板块萎靡,新经济概念集体走弱。

具体看,在港上市水泥股持续走强,山水水泥、中国建材涨9%,海螺水涨4.36%。预计2021年在疫情缓解情况下,水泥行业有望否极泰来,水泥价格全年有望正增长。认为此次水泥提价刚刚启动,后续随着开工旺季到来,水泥价格将持续上涨。

香港本地股今日也表现强势,莎莎国际大涨近7%,太兴集团、香港中华煤气、钢铁公司等多股跟涨。消息面上,市场或憧憬香港与内地不久能恢复通关,香港本地股亦走强。今日市场迎来大跌行情,濠赌股与香港本地股逆势上涨,表现较为抢眼。

博彩股涨势居前,永利澳门大涨近5%,澳博控股涨2.5%。澳门宣布昨日起所有自内地入境人士无须隔离,因此港股市场澳门概念股全线飙升。

铜、钢铁金属、有色金属等板块集体大跌,五矿资源跌超14%,江西铜业股份、中国有色矿业等跌超10%。国君(香港)发布研报称,高铜价预计将无法持续。由于世界其它国家仍在遭受新冠疫情的痛苦,全球铜的消费需求并未改善。预计铜价在未来几个月将会下跌。预计2021年年度铜均价在5500-6000美元/吨之间。

此外,SaaS板块大跌居前,中国有赞跌超10%,微盟、金山软件均跌超8%。

此外,汽车股持续走低,雅迪控股跌超10%,长城汽车跌超7%,比亚迪股份、吉利汽车均跌超5%。

恒生科技股方面,微盟和快手跌超7%领跌成分股。腾讯、阿里、小米跌超1%,美团、京东跌超4%。消息面上,市场连日沽售市值较高的美国科网股,拖累纳指昨晚曾急挫3.9%,考验万三关逼近一个月低位喘定,收市仅续吐0.5%。本港恒指科技指数也由纪录高位连跌第五天,今早跌幅扩至4.1%。

此外,香港交易所一度跌9%,此前据香港经济日报报道,香港将股票交易印花税提高至0.13%。目前该网站已撤下有关报道,港交所跌幅也已收窄至5.38%。

中信证券研报指出,展望未来3-6个月,预计全球经济复苏和再通胀预期仍将是市场的主旋律。预计政策刺激和经济复苏预期将继续支持Q1-Q2风险资产的表现。大类资产中相对看好大宗商品,尤其是工业金属和原油的涨价预期。

A股方面,天风证券表示,市场继续回调空间或有限,资金面处收缩阶段,市场整体盈利上行,市场将呈现结构性机会特征。行业角度,持续看好周期类行业;消费品行业精选一季报优质个股静待业绩催化;制造类行业关注半导体、电新等。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.