波司登(03998.HK):疫情下第三财季羽绒服流水增速持续强劲,“长冬+疫情恢复“看好Q4业绩高增,维持“买入”评级

机构:东吴证券

评级:买入

投资要点

事件:1 月 5 日,波司登发布 2020/21 财年前九月(2020 年 4-12 月)最新零售表现,品牌羽绒服业务中核心品牌波司登零售额同增 25%+,品牌羽绒服业务中其他品牌零售额同增 40%+。

羽绒服主业零售额增速符合预期,第三财季增速明显提升:公司 2020/21财 年 前 九 月 品 牌 羽 绒 服 中 波 司 登 / 其 他 品 牌 零 售 额 分 别 同 增25%+/40%+。尽管今年以来受到疫情的严峻考验,增速仍保持较快。另外,第三财季单季增速较 2020/21 财年上半年显著提升,2020/21 财年上半年波司登/其他品牌羽绒服营收增速分别为 19.7%/2.85%,据此估计,2020/21 财年第三财季无论波司登还是其他羽绒服品牌零售增速均有显著提升。

2020 年长冬下服装消费反弹明显,持续看好第四财季表现:2020 年国庆期间全国多地即出现明显降温,平均入冬时间提早 9 天,另外 2021年春节日期较晚,因此冬季消费期较以往更长,年末消费有望反弹。从国家统计局公布的数据看,2020 年 9、10 月服装限上增速持续提升,且据我们线下调研反馈,部分服装龙头及主要经销商也开始冬季补货,服装消费反弹趋势已基本确立。我们认为,2020/21 第四财季(2021 年 1-3 月)正逢春节前后,冬季复苏有望延续,且去年同期为国内疫情高峰,低基数下高增长值得期待。

品牌及产品升级重塑,价格带稳步向上:公司作为功能性服饰龙头,始终以品牌及产品品质为本,2017 年聚焦主航道以来,不断推动品牌及产品升级,致力于打造功能性与时尚型兼具的产品,包括坚持以匠心实现产品功能性突破、通过 IP 联名以及知名设计师合作提升产品时尚感等。随着品牌的不断升级,公司平均价格带逐步向 2000-2500 元提升,高于大众市场 900-1000 元的均价,在中高端价格带地位稳固。

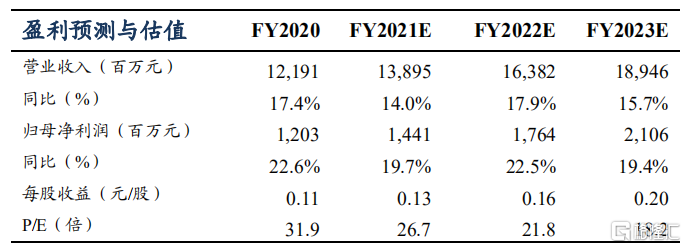

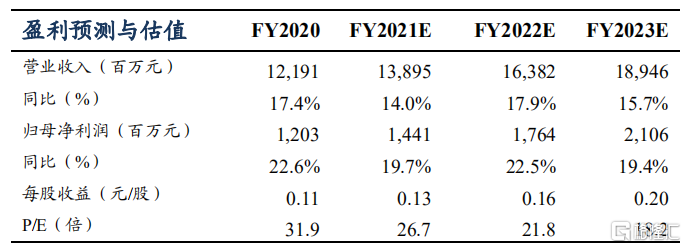

盈利预测与投资评级:波司登是国产羽绒服龙头企业,2020 年“双 11”线上全渠道销售额达 15 亿元,居中国服装品牌首位。我们认为未来中高端羽绒服市场将持续增长,波司登作为国产品牌升级的典范,在天时地利人和三重利好下业绩有望持续高增。我们预计公司 FY2021-2023归母净利分别为 14.4/17.6/21.1 亿元,同增 19.7%/22.5%/19.4%。当前股价对应 PE 为 27/22/18x,维持“买入”评级。

风险提示:品牌升级不及预期,气温波动异常,疫情反复等。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.