中国铁塔(00788.HK):净利双位数增长,业务多元扩张,维持“买入”评级,目标价1.77 港元

机构:兴业证券

评级:买入

目标价:1.77 港元

投资要点

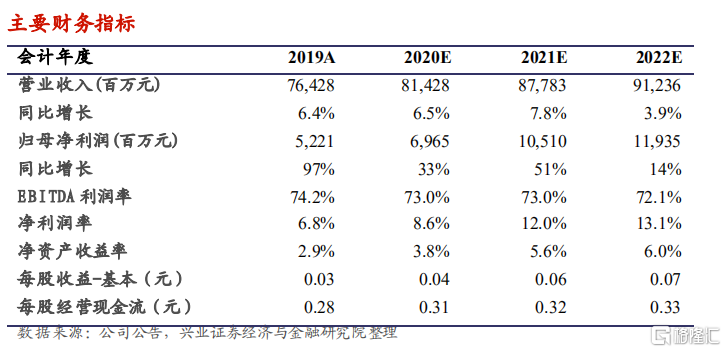

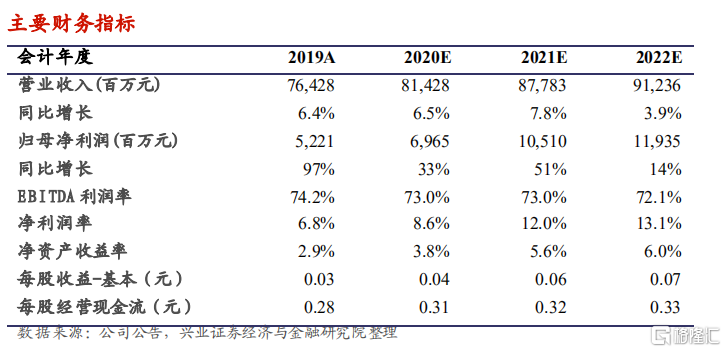

三季度归母净利同比增 长 17.8%,塔类站均租户稳定增长。中国铁塔前三季度营业收入 602.2 亿元(人民币,下同)(+5.6%),EBITDA 440.2 亿元(+5.4%),EBITDA 率为 73.1%,同比下降 0.2pcts;归母净利润 45.6 亿元(+17.8%)。公司前三季度净利润率为 7.6%(+0.8pcts),第三季度净利润率为 7.8%;前三季度营收增长同比分别为 4.2%、5.4%、7.2%,随 5G基站建设速度和规模的加大,呈现加速提升。

塔类站址 202 万座,租户数 333.6 万户,塔类站均租户数提升至 1.65。公司塔类站址较 2019 年底增加 2.6 万座,租户数达到 333.6 万户,站均租户数 1.65 户/站,较 2019 年底增加 0.03 户/站。2020 年前三季度公司完成 34.5万个 5G 基站站址交付,97%以上 5G 需求通过共享已有站址资源完成。根据工信部的统计,2019 年全国 4G 基站总数达 544 万站, 5G 宏基站预计需要达到 4G 的 1.2-1.5 倍,整个 5G 周期宏基站总数将超过 650 万站,为长期增长提供支撑。

公司多点支撑业务格局加速形成,收入结构长期有望改善。公司前三季度塔类业务收入 548.0 亿元(+5.6%),室分业务收入 26.3 亿元(+36.9%),跨行业及能源业务收入 26.1.亿元(+92.8%);公司整体非塔类业务收入(包括室分业务和跨行业及能源业务收入)占比从去年同期的 5.7%提升到8.7%,“一体两翼”战略加快形成,营收结构长期有望改善。

投资建议:放眼整个 5G 建设周期,公司未来的站址数伴随 5G 建设浪潮仍将保持稳定增长。我们采用 DCF 法进行估值,保守假设融资成本和投资现金流,下调目标价 4%至 1.77 港元,对应 2020 年 EV/EBITDA 为 6.1,距离 10 月 23 日收盘价有 37.2%的空间,维持“买入”评级。

风险提示:1)运营商资本开支下降;2)5G建设不及预期;3)产品价格调整。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.