机构:浙商证券

评级:买入

投资要点

销量稳健增长,瓦楞纸、灰底白板销量表现靓丽

报告期内,公司造纸业务实现销售额511.66亿元(-5.9%),销量1530万吨(+8.5%);纸浆业务销售额1.75亿元(-23.3%)。细分纸种来看,(1)包装纸:期内实现收入445.19亿(-5.09%),销量1434万吨(+1.73%),单价3103.7元/吨(-6.78%);其中牛卡纸、瓦楞纸、灰底白板销量分别为737、396、280万吨,同比+6%、+16%、+15%,占包装营收占比分别为46.4%、21.7%、18.6%;瓦楞纸、灰底白板销量表现靓丽。(2)文化纸:期内实现收入57.80亿(-10.8%),销量102万吨(-8.0%),单价5674.48元/吨(-3.1%)。(3)特种纸:期内实现收入8.67亿元(-12.85%),占总营收比例1.69%。

疫情下单吨盈利承压,看好下半年景气提升

(1)上半年疫情&春节影响公司生产经营,销量为680万吨,环比减少170万吨;价格方面前期由于复工后废纸脉冲供给产业链价格集体下调,箱板纸较3月高点4577元/吨下降至5月3777元/吨,对应公司剔除汇兑损益后的吨净利仅为221元/吨,环比下降22.1%。(2)下半年下游需求复苏叠加原材料限制,预期箱板纸价格向上。伴随下游需求有所修复叠加原材料限制(前11批外废配额合计594.31万吨,较去年同期减少480.88万吨,带动国废价格自4月初1785元/吨上升至目前2180元/吨),本周箱板纸、瓦楞纸价格4510、3658元/吨,基本持平,较5月初低点上涨750元/吨、550元/吨。预期箱板纸传统旺季将至,渠道库存持续消化(8月社会库存136.1万吨,较6月下降9.5%;龙头企业),此外白卡、白板持续提价拉开与箱板纸价差,预期箱板纸价格稳定向上,利好公司盈利释放。

人民币进入升值周期,玖龙显著受益

近期美元兑人民币汇率持续抬升,目前为6.8238,较5月底升值4.9%,且预期人民币尚处于升值通道之中。由于人民币汇率波动影响木浆、废纸采购成本,以及美元营运资本、美元债务等经营数据,因此对于进口型的造纸板块较为利好。由于玖龙纸业外废采购量相对较大、且美元借款占比较高显著受益。根据我们详细测算,人民币汇率升值1%,对应玖龙纸业提升净利润58.95百万元,参考2020财年净利润,对应提升净利润提升1.4%。

浆纸产能有序扩张,逐步推进产业链一体化

报告期内泉州35万吨、沈阳60万吨包装纸、马来西亚再生浆投产;截止20H1公司合计拥有纸、浆产能1732万吨,其中纸1647万吨、浆85万吨(海外15万吨木浆、70万吨再生浆)。(1)纸:20H2计划河北、东莞共计110万吨箱板纸产能投产,22Q2马来西亚55万吨包装纸投产,2022Q3湖北浆纸基地新增120万吨包装纸产能,预期2022年底合计造纸产能达1932万吨。(2)浆:于湖北荆州筹备首个浆纸一体化项目,其中包括60万吨木浆产能;计划扩张沈阳60万吨木浆产能;预计2022年底浆产能超200万吨。此外于19年9月公司收购包装厂延伸至下游产业链,总设计年产能为10亿平方米,对公司扩大业务量、提升受益带来多方协同效益。

毛利率小幅上行,费用管控良好

报告期内毛利率同比增长2.14pct至17.58%,其中20H1公司毛利率同比增长2.45pct至17.77%,主要系期内原材料废纸价格跌幅大于原纸价格。期间费用率合计8.01%(+0.31pct),其中销售费用率3.05%(+0.2pct);管理费用率3.62%(+0.51pct);财务费用率1.34%(-0.4pct)。综合来看,报告期内公司归母净利率为8.14%(+0.20pct),20H1归母净利率由去年同期6.56%上行至8.18%。

负债率持续下滑,经营现金流表现靓丽

期末公司资产负债率为48.57%,较去年同期下滑1.81pct。期末公司应收账款合计45.97亿元,较期初增加6.13亿元,应收账款周转天数30.08天同比减少2.8天;账上存货52.46亿元,较期初增加6.13亿元,存货周转天数同比減少1.03天至54.68天,预计系20H1销量较低相关;账上应付账款及票据54.73亿元,较期初减少1.13亿元。期内公司经营性现金流量净额89.49亿元(+3.61%),表现优异。

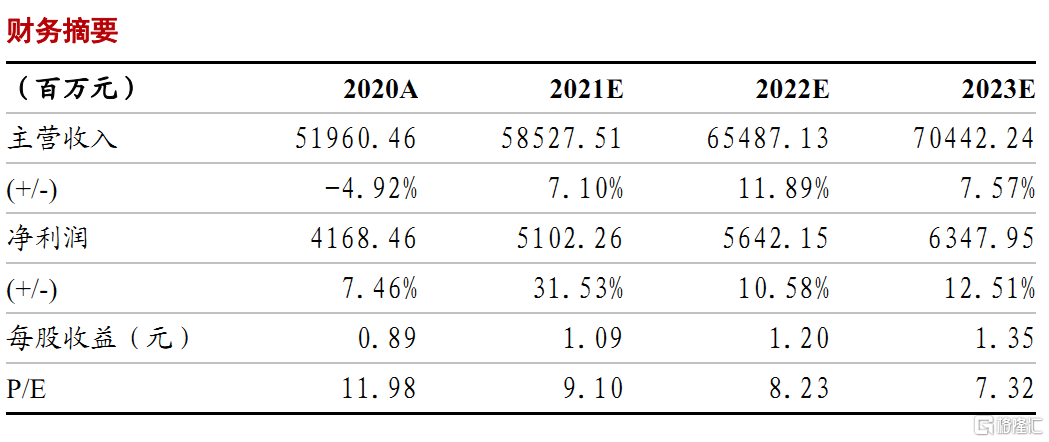

盈利预测

预计公司21-23财年实现营业收入585.3/654.9/704.4亿元(+7.1%/+11.9%/+7.6%),归母净利51.0/56.4/63.5亿元(+31.5%/+10.6%/+12.5%),对应PE为9.1X/8.2X/7.3X,考虑到公司盈利具有较大的向上弹性且目前估值显著偏低,给予“买入”评级。

风险提示

原材料价格大幅波动,竞争加剧,二次疫情