【中泰宏观】结构宽松为主,降息“门槛”提高

作者:梁中华 吴嘉璐

来源:梁中华宏观研究

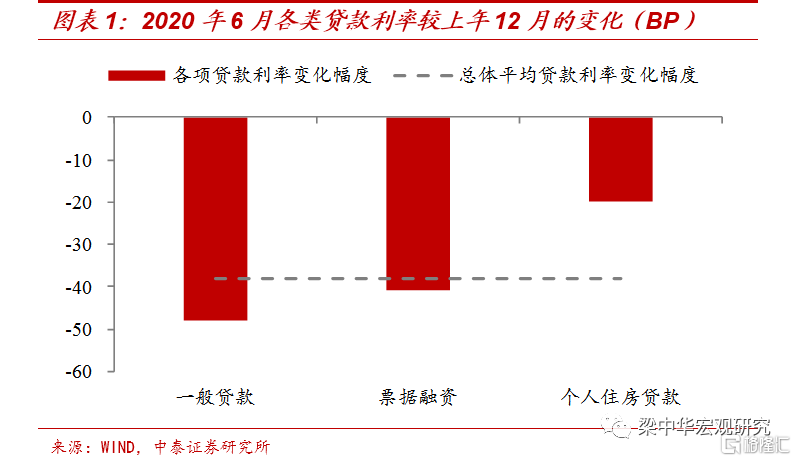

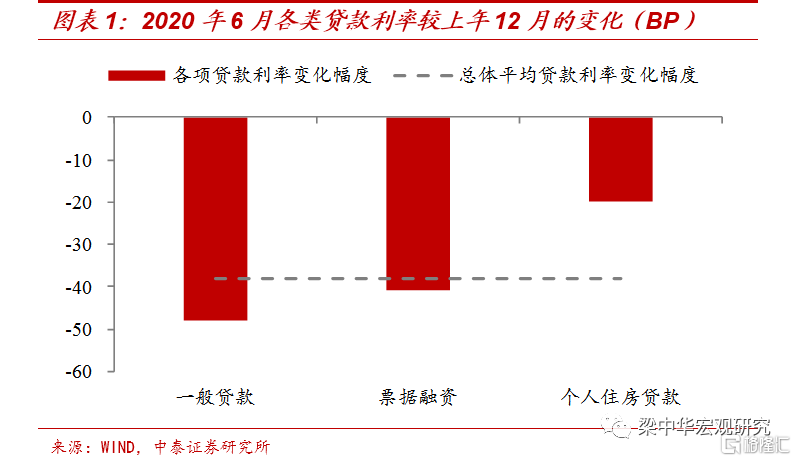

1、贷款利率大幅下降。

央行公布的6月金融机构贷款加权平均利率,较去年12月大幅下降了38个bp至5.06%。其中,一般贷款和票据融资利率下行幅度较明显,6月一般贷款利率为5.26%,较去年12月下降了48个bp;票据利率较去年末下降了41个bp至2.85%。个人住房贷款利率较去年末也下降了20个bp至5.42%,但降幅低于平均水平。环比来看的话,各类贷款利率仍在下行。

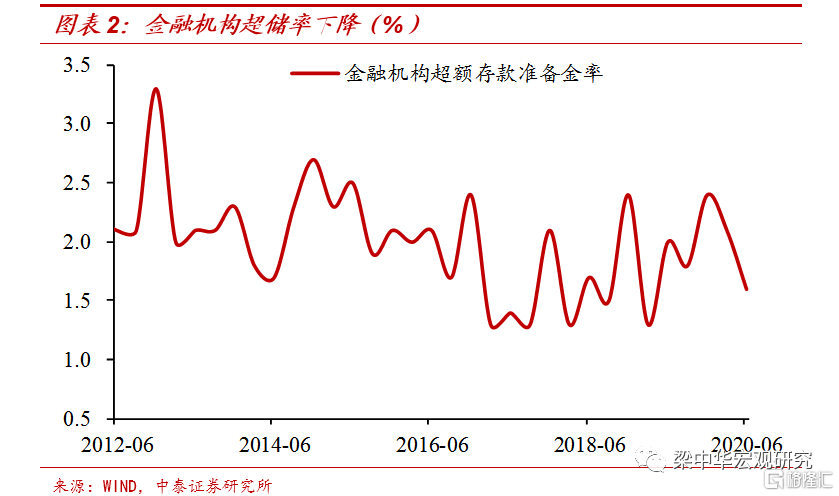

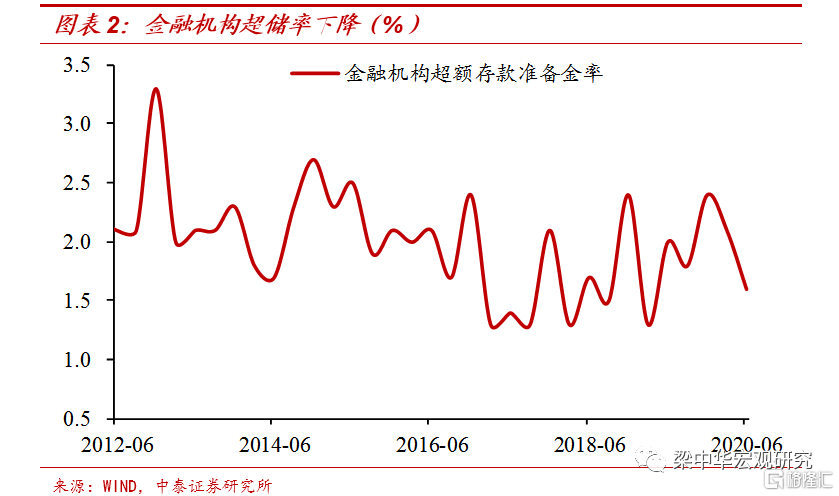

6月金融机构超储率为1.6%,比去年同期低0.4个百分点,或源于存款准备金利率下调,银行信贷投放的意愿有所增加。

2、加强结构性货币政策工具,提高“直达性”。

在专栏一中,央行指出宏观经济运行中存在摩擦,市场体系面临市场失灵的风险,微观主体在现实中是异质性的,如果货币政策只注意总量,则会造成更大的结构扭曲,总量目标也难以实现。因此结构性货币政策有利于提高资金使用效率,促进信贷资源流向更有需求、更有活力的重点领域和薄弱环节。

下一阶段,人民银行将进一步有效发挥结构性货币政策工具的精准滴灌作用,提高政策的“直达性”,引导金融机构加大对实体经济特别是小微企业、民营企业的支持力度。

3、珍惜正常货币政策空间,降息“门槛”大幅提高。

央行在专栏四中对全球低利率的情况进行了探讨,指出经济潜在增速下降等长期结构性因素是全球低利率的主要原因。但低利率的政策效果相对有限,因为低利率难以改变经济潜在增速,很难解决经济的结构性问题;低利率也会增大银行的利润下降压力,甚至带来紧缩效应;利率和通胀预期可能同步下降,导致实际利率不变。此外,利率过低还会导致“资源错配”“脱实向虚”等诸多负面影响。

所以央行努力实施正常的货币政策,保持利率水平与我国发展阶段和经济形势动态适配,本外币利差处于合适区间,人民币资产吸引力上升。

往前看,央行会非常珍惜正常货币政策的空间,我们认为,进一步降息需要等待国内经济基本面的明显下滑。

4、经济仍然面临不少挑战,政策大转向可能性不大。

央行在报告中指出,国际疫情仍处于较长的高峰平台期,地缘政治紧张局势抬头、部分国家间经贸摩擦日益深化,不稳定性不确定性较大。我国防范疫情输入和世界经济风险的压力仍然较大,疫情对国内经济运行的冲击仍在,经济运行中还存在一些结构性、体制性、周期性问题。在承认经济恢复成绩的同时,央行也强调了未来经济可能面临的下行压力。

5、稳增长和防风险均衡,结构宽松政策为主导。

关于下一阶段政策,央行指出要坚持稳中求进工作总基调,坚持新发展理念,稳健的货币政策更加灵活适度、精准导向,保持货币供应量和社会融资规模合理增长,完善跨周期设计和调节,处理好稳增长、保就业、调结构、防风险、控通胀的关系,实现稳增长和防风险长期均衡。要增强针对性和时效性,根据疫情防控和经济金融形势把握货币政策操作的力度、节奏和重点,坚持把支持实体经济恢复与可持续发展放到更加突出的位置,综合运用并创新多种货币政策工具,保持流动性合理充裕,疏通货币政策传导机制,有效发挥结构性货币政策工具的精准滴灌作用,提高政策的“直达性”。

风险提示:疫情发酵,经济下行,政策变动。和修改。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.