Canalys:2019年第四季度中国智能手机出货同比下降15%

作者:Canaly

来源:Canaly

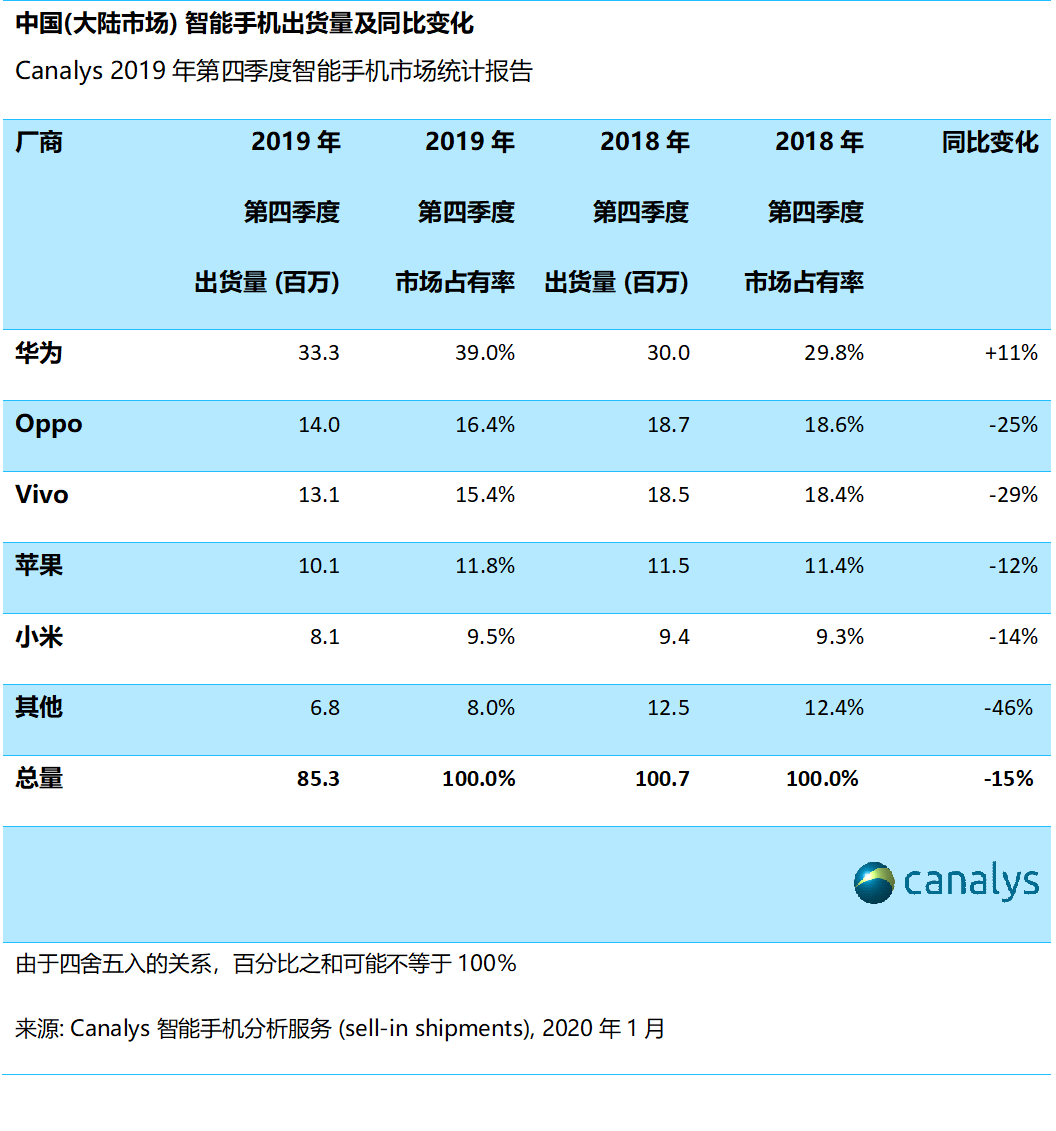

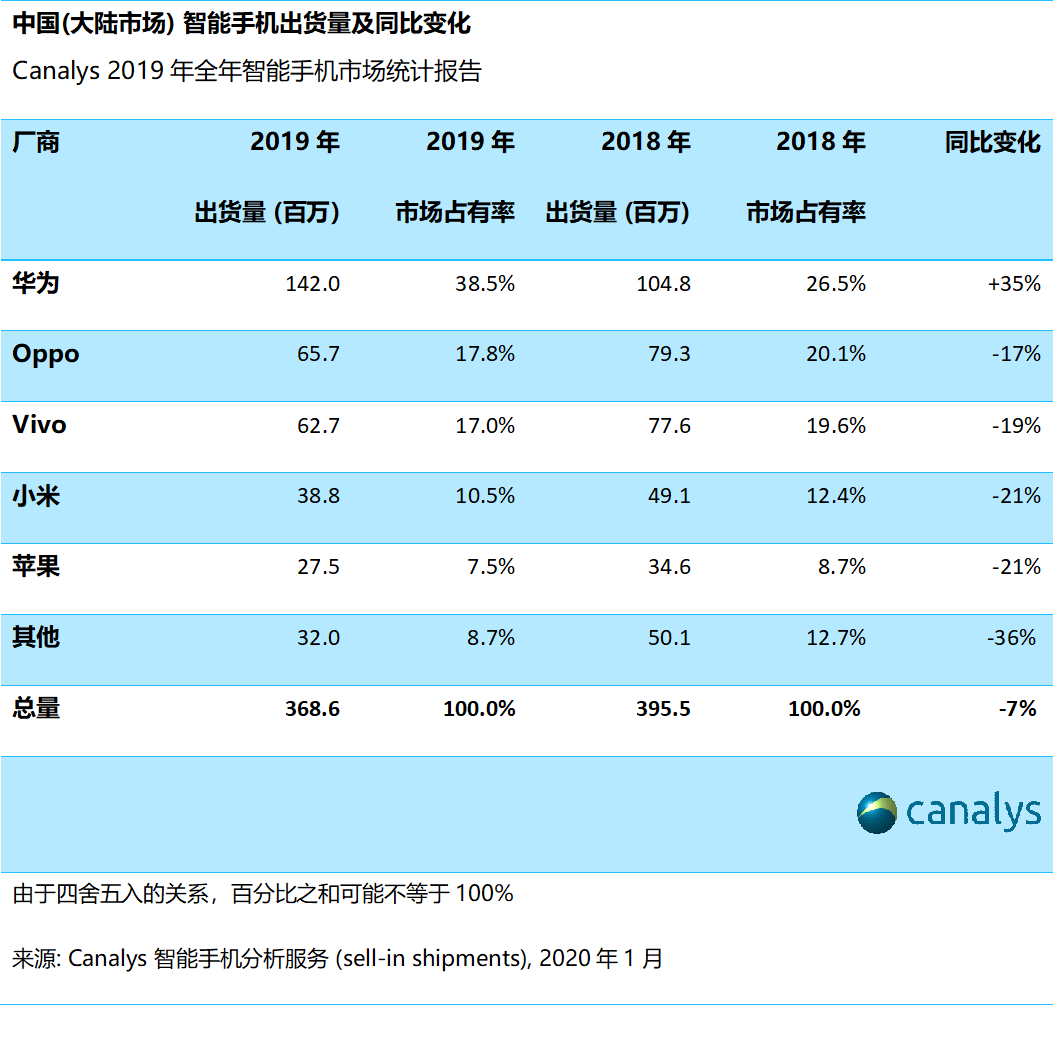

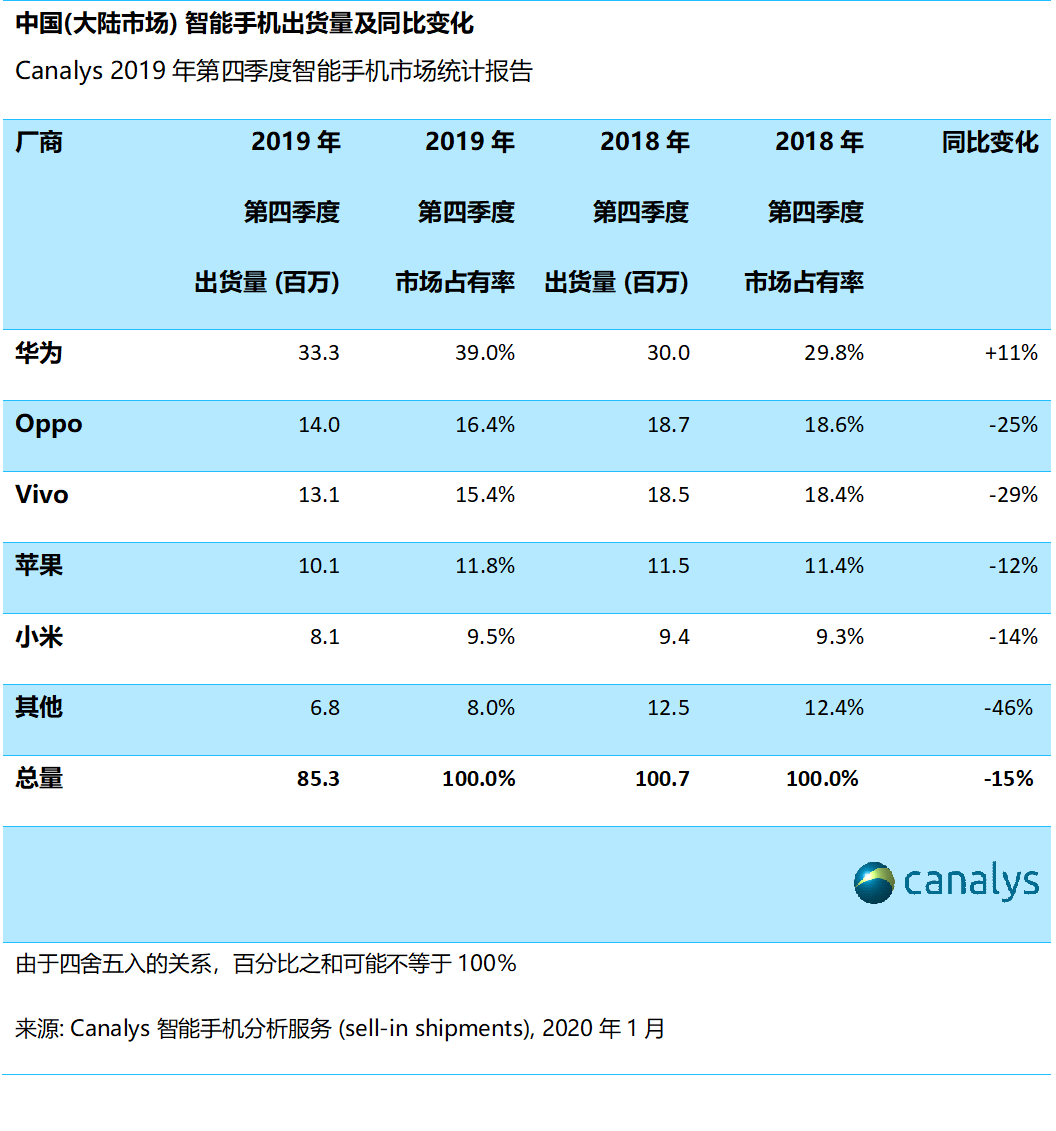

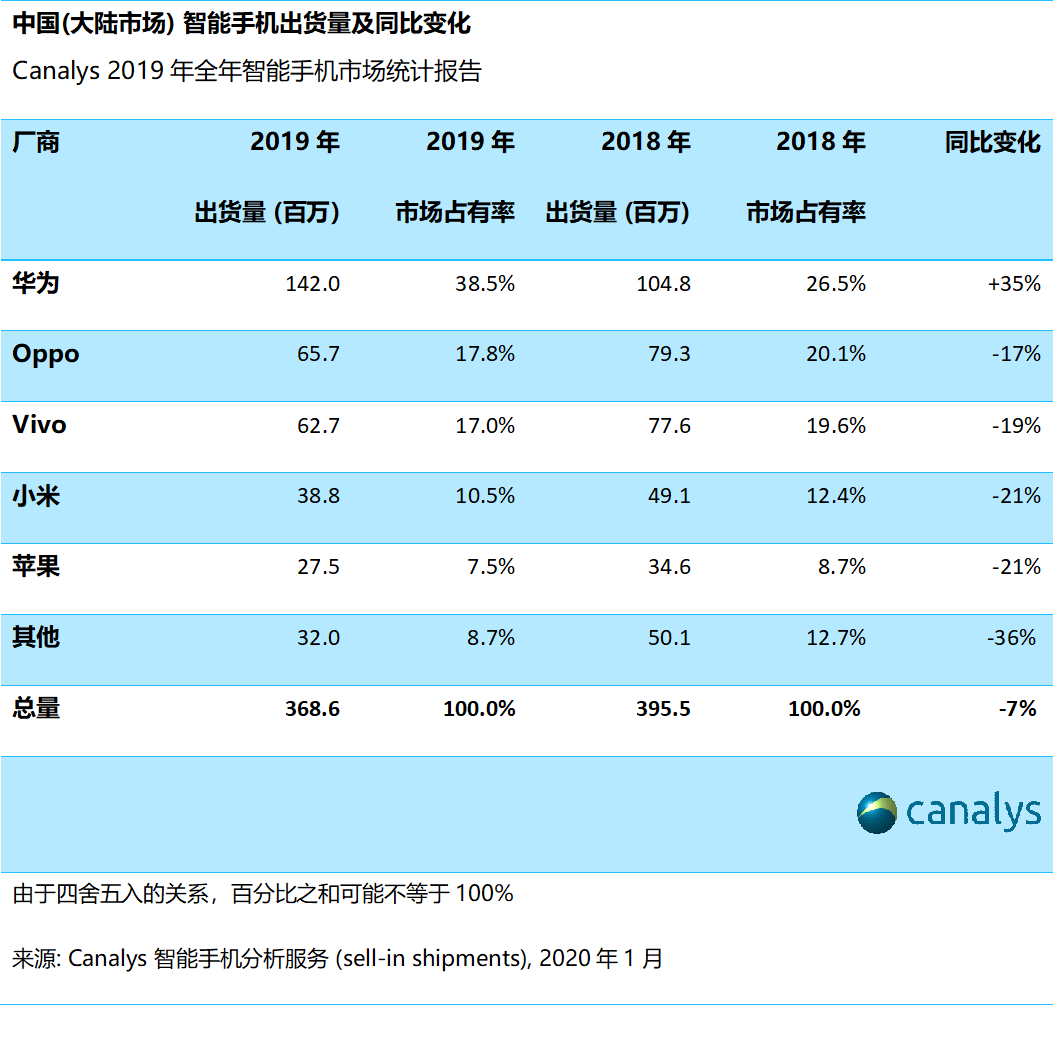

据全球科技行业权威调研机构Canaly最新数据,中国(大陆市场)智能手机市场在2019年第四季度出货量下降15%,至8530万部,这是连续第11个季度下跌,创下了2013年第一季度以来的七年新低。2019年全年,国内市场出货量3.69亿台,同比下降7%。在第四季度的智能手机传统销售旺季,2019年第四季度市场表现明显反常。4G手机市场饱和导致的销售大幅放缓,加上主要厂商的5G手机需求不如预期的旺盛。与此同时,在2020年5G大幅推广前,渠道开始消化4G库存。华为保持了在中国的领先地位,市场份额达39%,出货同比增长了11%。但是环比出现了两成的下降。Oppo和Vivo仍然排在第二和第三位,出货量分别同比下降25%和29%。苹果排名上升一位,排名第四,小米排名第五。

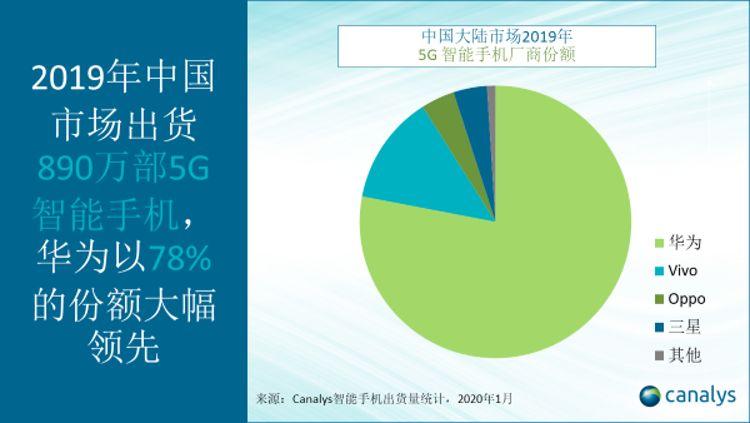

华为第四季度在中国的智能手机出货量超过3300万部。对于其过去12个月保持增长的亮眼业绩,市场需要有所留意。Canaly移动副总裁Nicole Peng说:“第二季度和第三季度的渠道库存增加对华为第四季度的业绩产生了不利影响。“随着4G智能手机(尤其是中高端智能手机)的销售日趋困难,在2020年华为要说服分销合作伙伴增加华为产品份额将会遇到阻碍。尽管华为以78%的份额领先5G智能手机出货,但在更多5G智能手机涌入市场之前,该厂商必须帮助渠道合作伙伴缓解4G设备库存压力。”

苹果成功扭转了颓势,中国智能手机第四季度的市场份额为11.8%,创下八个季度以来的最高纪录。苹果将同比降幅缩小至12%,售出1000万部iPhone。“iPhone11具有竞争力的定价对苹果公司第四季度的业绩贡献很大,”Peng说。“鉴于国内行业各玩家正全速发展以5G手机取代4G,消费者可能会暂停更换手机以等待5G的到来。iPhone11系列正逆势而上,是中国市场上最畅销的4G智能手机。这表明,在价格合适的情况下,鉴于硬件和服务生态系统的优势,苹果产品仍有强劲的拉动因素。这将有助于在其5G版iPhone推出时吸引到比往代更多的用户进行升级换机。”

Oppo和Vivo在市场下跌中首当其冲。Canaly 研究分析师Louis Liu表示:“在华为的强攻下,第四季度Oppo和Vivo在渠道明显需求不足。“不过,两家也有释放出正面积极的讯号。Vivo在2019年成为5G智能手机出货量仅次于华为的第二大厂商,出货量达120万部。Oppo的Reno新品牌也开始显示出希望,因为它的Reno 3系列在一周内出货超过40万台。两家厂商都决心正面迎战华为,并准备在2020年与更强大的5G智能手机产品组合抗争。”

“随着今年5G的广泛推广和运营商给予的更多激励措施,预计到2020年5G智能手机出货将超过1.5亿部。较小规模的厂商希望打破主要品牌的市场支配地位,而前五名之间的竞争也将是残酷的,”Peng补充说。“随着冠状病毒爆发的黑天鹅事件,整体市场出货也面临着市场萎缩的压力。这次的疫情将对中国的科技制造业、零售业和消费者消费产生重大而持久的不利影响。在疫情持续发展下,厂商必须开始为其带来的业务风险和业务影响做好准备。”

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.