中国燃气(00384.HK):俄气东入,东北天然气用气量潜力大,维持“买入”评级,目标价37.4港元

机构:兴业证券

评级:买入

目标价:37.4港元

投资要点

东北三省用气量低。2018年东北三省用气量为141.56亿立方米(包含大庆、吉林和盘锦油田自用气40亿方),黑龙江省用气量为42.2亿方,辽宁和吉林2018年用气量一共为99.36亿方。中国燃气2018年在东北三省的销气量为20.4亿方,其中黑龙江销气量为6亿方,吉林和辽宁销气量为14.37亿方。

黑龙江首先受益于俄气的输入。2019年12月1日俄气将通过黑河进入国内,黑龙江省首先受益于俄气的输入,省内也采取了加大天然气使用的配套政策,如加大城市管道建设、储气能力建设、鼓励取暖用天然气、工业煤改气等。

中国燃气在东北三省布局早,投资规模大。中国燃气在东北三省120个城镇开展了燃气管网投资建设,已获得特许经营权范围覆盖人口5007万人,已接驳城市管道燃气用户2629万人,尚有农村1317万人,城市1061万人需要开发。公司在城镇燃气、长输管线、供热、分布式能源、合同能源管理、加气站等项目的总投资额超过100亿元。

居民取暖用气及工业煤改气成为黑龙江用气量增长引擎,交通用气也将持续增长,不会被电动车取代。随着城市的发展,原先提供供暖业务的燃煤锅炉厂变成了城市核心区域,地块价值凸显,但是其燃煤堆场紧挨着居民区,周边的居民对周边居住环境要求提高,燃煤锅炉厂正常经营受到居民的抵抗,因此原先的燃煤锅炉改成天然气锅炉具有可行性。随着环保政策趋紧,环保标准也在逐步提高,工业企业的环保配套投入成本较大,也促使了工业企业进行煤改气。

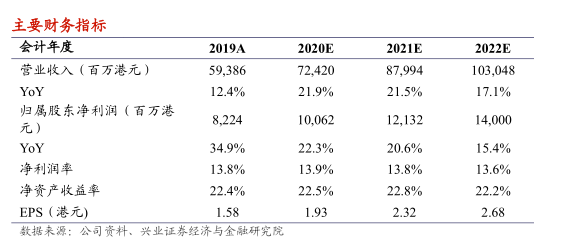

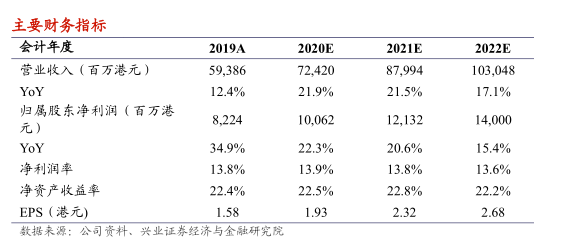

我们的观点:中国燃气(0384.HK)布局黑龙江和辽宁时间较久,投资规模大,正在加大吉林省投入,随着俄气输入,公司东北三省的项目将会受益,带动公司在东北三省气量的高速增长,我们维持公司的盈利预测,预计公司2020-2022财年营收分别为724.20、879.94和1030.48亿港元,归母净利润预测为100.62、121.32和139.99亿港元,EPS分别为1.93、2.32和2.68港元,维持“买入”评级,目标价维持为37.4港元。

风险提示:俄气进入的进度较慢,城镇煤改气进展缓慢,气源成本大幅上涨。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.