Overview

- EVgo has multiple sources of revenue and has key partnerships with leading OEM.

- The company reported a 90% year-on-year increase in revenue in the second quarter.

- The business model of electric vehicle charging is still developing, and the field is innovating rapidly.

EVgo (NASDAQ: EVgo) has a large and growing network of chargers, rich experience in the development and operation of fast charging infrastructure, partnerships with OEM and the team, and a mature brand name that distinguishes it from its competitors. In the long run, its expertise and experience in fast charging infrastructure will give it an edge in the competition. The stock looks highly valued, but the company's revenue is growing rapidly and has the potential to meet that valuation.

EVgo is the largest public fast charging network for electric vehicles in the United States, with more than 850 fast charging places, about 1670 fast chargers and serving more than 444000 customers. EVgo's charging stations are powered entirely by renewable energy. The company has a variety of sources of income. First, it sells electricity directly through fast charging stations. EVgo owns and operates these stations in parking spaces owned by commercial owners, landlords or tenants. The company also provides site hosts with the option of owning the site, which is maintained by EVgo.

Second, EVgo signed a contract with OEM to provide charging services for drivers using OEM electric vehicles. Third, the company directly signs contracts with a large number of fleet customers to use public chargers according to customer needs and usage patterns. It also provides dedicated charging solutions for the fleet, including charge-as-a-Service or ChaaS. Finally, the company offers a variety of software-driven services, such as digital application customization, fee data integration, loyalty programs and fee bookings.

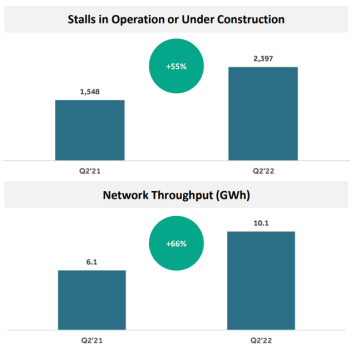

Strong growth

EVgo's second-quarter revenue was $9.1 million, up 90 per cent from a year earlier. This growth is driven by higher retail charging revenue, as well as growth in online OEM and regulatory credit revenue.

The company has added about 67000 customer accounts, and the total number of customer accounts has exceeded 444000, an increase of 60% over the same period last year.

During the quarter, the company also announced partnerships with General Motors (General Motors) and Pilot company. Under the agreement, EVgo will install and operate 2000 new stalls in about 500 locations in the United States for GM and Pilot company in the next few years.

EVgo has reached an agreement with General Motors to install 3250 chargers by the end of 2025 and has partnered with Nissan to install 210chargers by February 2024. Overall, EVgo is rapidly developing its charging network. The company also has more than 2.5 million users on its PlugShare platform.

EVgo's large and growing network of chargers, rich experience in the development and operation of fast charging infrastructure, partnerships with OEM and the team, and a mature brand name distinguish it from its competitors. These factors have contributed to the company's strong growth in recent years. EVgo specializes in DCFC fast chargers, which operate from 200V to 1000V DC with a power supply of at least 50kW. The company expects the DC fast charging market to grow faster than the entire electric vehicle charging market. With the increasing adoption of electric vehicles, fast charging may be the first choice for many drivers.

Electric vehicle charging system is developing rapidly

With the increasing use of electric vehicles, there is no doubt about the demand for electric vehicle charging stations. In the United States, the market share of electric vehicles more than doubled in 2021. Electric vehicle charging system is developing rapidly to meet the needs of electric vehicle drivers, and it is also looking for a feasible business model. Electric vehicle charging operators do not have a fixed way to generate revenue; instead, they work on multiple models and resources at the same time.

For example, Volta (VLTA) generates revenue by doubling the charger as an advertising screen. Similarly, EVgo sees advertising as a key potential way to increase revenue. These innovations are aimed at finding a viable business model because electric car charging companies understand that it is difficult to make a profit by selling electricity from power stations alone.

Another example of innovation in this area is connecting non-networked household chargers and making them available to the public. Companies such as EVmatch and Power Hero believe that this concept will become the Airbnb (ABNB) in the field of electric vehicle charging. While EVmatch requires homeowners to purchase or rent new charger equipment to connect to the Internet, Power Hero provides a small and innovative adapter to make any household charger a networked charger without replacing the old charger. If this concept is widely adopted, it could make more than a million home chargers available to the public in the United States, which will help increase the use of electric vehicles, which in turn will benefit electric car charging companies.

As a result, several companies are studying different models and have made a lot of innovations in the field of electric vehicle charging. While this bodes well for EVgo, there are some key risks to consider.

Risk

The first risk is related to the profitability of EVgo. So far, no electric car charging company has made a profit. As the system continues to change, it is unclear how or when EVgo or its competitors will eventually be profitable.

Secondly, the company is facing increasingly fierce competition from other companies, such as ChargePoint (CHPT), Blink Charging (BLNK), Volta, Electrify America and so on. Compared with the secondary charger, the installation and charging cost of the fast charger is higher. Although EVgo also has a level 2 charger, its main focus is on fast chargers. If the driver of an electric car chooses two-stage charging because of its cost advantage, then EVgo will be at a disadvantage because its secondary charging network is negligible compared to ChargePoint or Blink charging.

Valuation

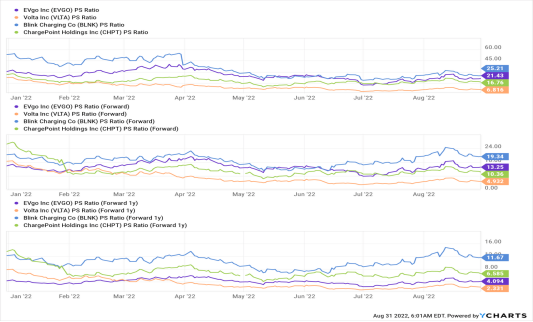

With a price-to-market ratio of 21, the stock price is not cheap, and the company's path to profitability is not yet clear, value investors may not want to take a second look at it at all. However, the company's industry is still growing, there is a long growth track, and its revenue is growing rapidly.

As shown in the chart above, analysts expect EVgo's revenue growth to be higher than ChargePoint's, which is reflected in its low 1-year PS ratio. Relatively speaking, EVgo looks the best among the electric car charging companies listed in the United States.

Conclusion

EVgo's large and growing network of chargers, rich experience in the development and operation of fast charging infrastructure, partnerships with OEM and the team, and a mature brand name distinguish it from its competitors. In the long run, its focus and experience in fast charging infrastructure will give it an edge in the competition. The stock looks highly valued, but with rapid revenue growth, the company has the potential to achieve that valuation. It has just started and there is still a long way to go. Overall, EVgo seems to be a hot bet in electric vehicle charging.