What is “Price-Order Triggering”?

What is “Price-Order Triggering”?

“Price-Order Triggering” a combination strategy tool, suitable for trading warrants and CBBCs. This order can be triggered by tracking the prices of related stocks or index of warrants or CBBCs. Investors can customize the trigger conditions and commission settings. When the tracked stock or index reaches the specified price and market conditions, the smart order will be triggered.

Instruction

Suppose you want to buy a warrant or CBBC and believe it has a strong correlation with its stock, you may use the “Smart Order” – “Price-Order Triggering” combination strategy.

Let's look at the steps:

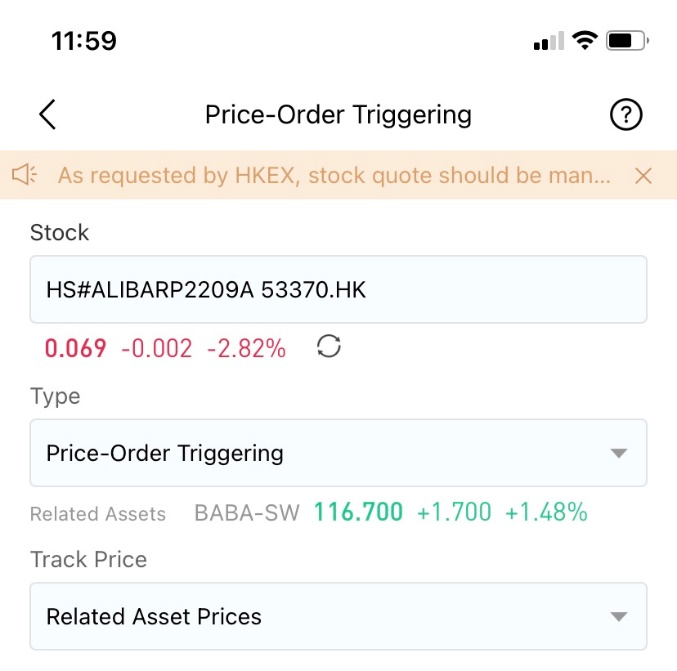

STEP 1 Select stock

Enter the warrant or CBBC for “Price-Order Triggering”. Choosing “Own Price” in “Track Price” column, the order will be triggered by the price of the warrant or CBBC. Choosing “Related Asset Prices” in “Track Price” column, the order will be triggered by the price of the related stock. After the system recognizes the warrant or CBBC, the default tracking asset is “Related Asset Prices” and the quotes of the CBBC and the related stock price will be displayed.

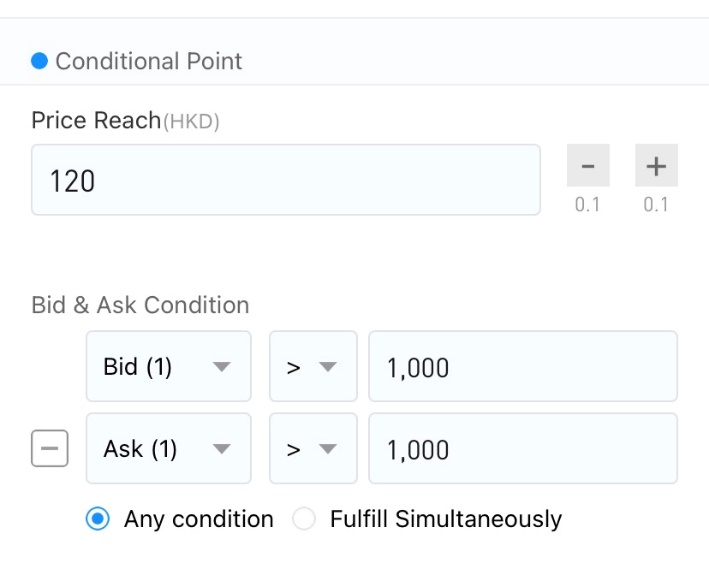

STEP 2 Set a conditional point

Set the price, the order will be triggered when the tracking asset reaches the set price only.

Set bid & ask condition. This item is not required, it is deemed that there is no requirement for trading if you leave it blank. Otherwise, the order will be triggered when the bid & ask quantity meet the requirements.

Bid & ask condition can choose to meet any one of the conditions, or both at the same time.

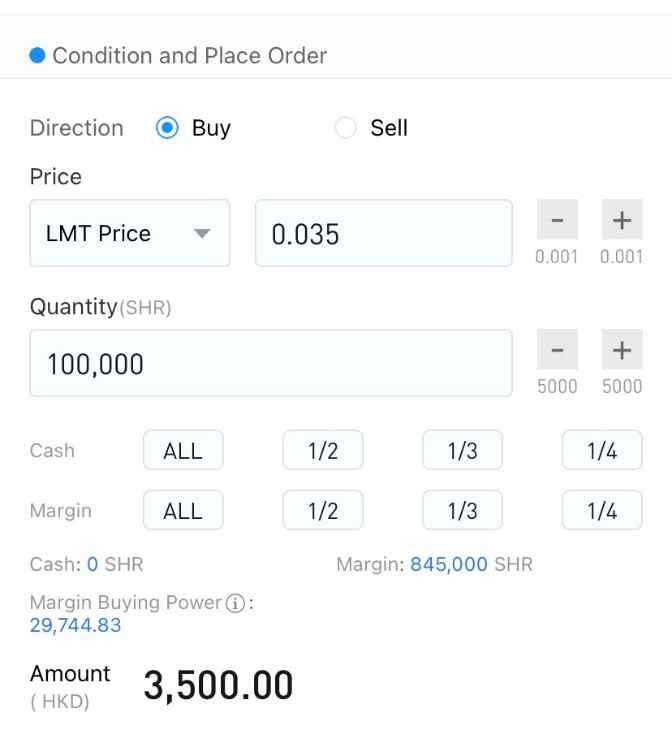

STEP 3 Set the condition

Select direction and order type.

For order type, you may choose enhance limit order or market order. To select an enhanced limit order, you need to manually enter the commission price and the commission will be based on the set price after the order is triggered. To select a market order, the commission will be based on the market price after the order is triggered.

Set the Quantity

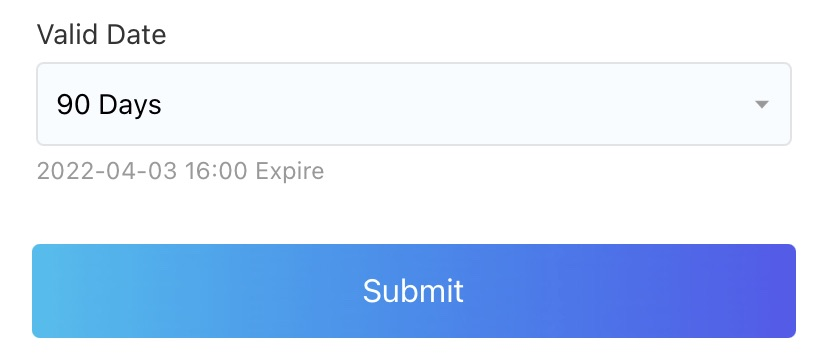

STEP 4 Select effective time and place order

For the valid date, same day/ 2 days/ 3 days/ 1 week/ 2 weeks/ 30 days/ 60 days/ 90 days are available, and can be extended by changing the order.

Click unlock to trade and submit order. The submitted order can be viewed under the smart order page, and the order can be modified as needed.

Order time

Anytime

Order valid date

Same day/ 2 days/ 3 days/ 1 week/ 2 weeks/ 30 days/ 60 days/ 90 days are available, and can be extended by changing the order.