What is “Stop-Loss”?

What is “Stop-Loss”?

Contrary to “Take-Profit”, investors set an decrease rate according to the latest price, the system will place an order automatically after the condition is triggered. It can be used to stop the loss when your stock holdings fall.

“Stop-Loss” smart order currently supports US stock pre-market and after-hours trading.

Instruction

When you make a mistake in investing in a stock, you want to avoid bigger loss. You may set the conditions through “Smart Order” - “Stop-Loss” to sell a stock based on the % of decrease.

Let's look at the steps:

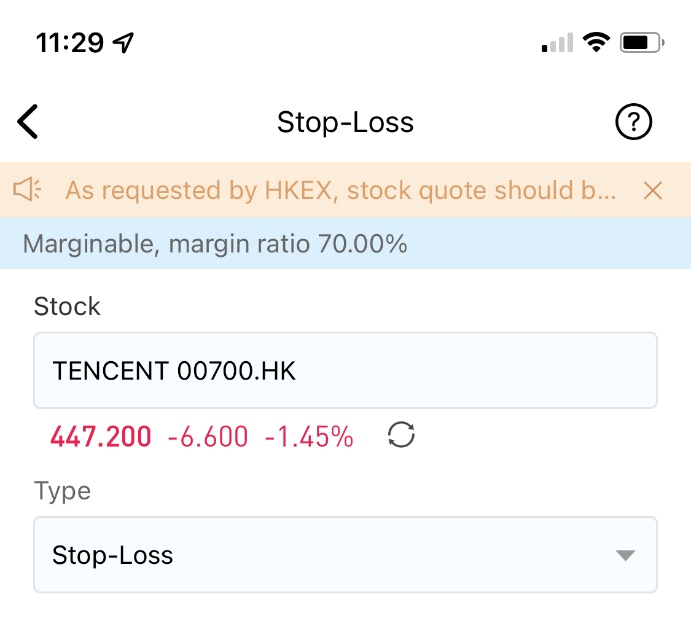

STEP 1 Select stock

Enter the stock for “Stop-Loss”.

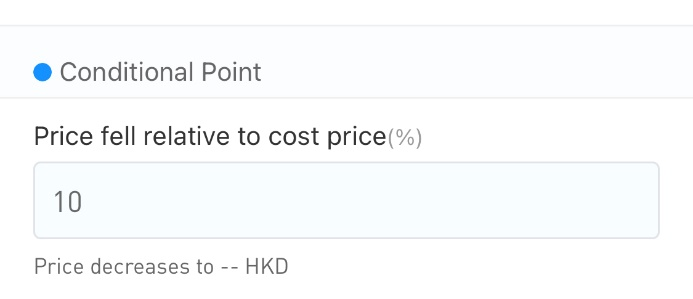

STEP 2 Set a conditional point

Input the % of decrease, which is generally the maximum loss that can be tolerated.

Fill in the appropriate % of decrease based on your analysis of a stock. When the stock price drops to or exceeds a specified range, the sell order will be triggered.

When the market price suddenly drops below the trigger price specified by the client, the stop-loss sell order will be triggered by the lower market price (rather than the client’s specified trigger price).

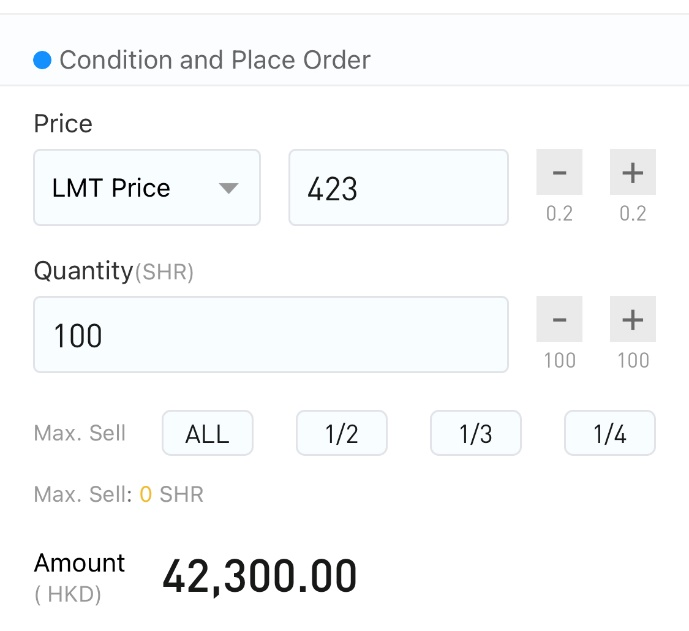

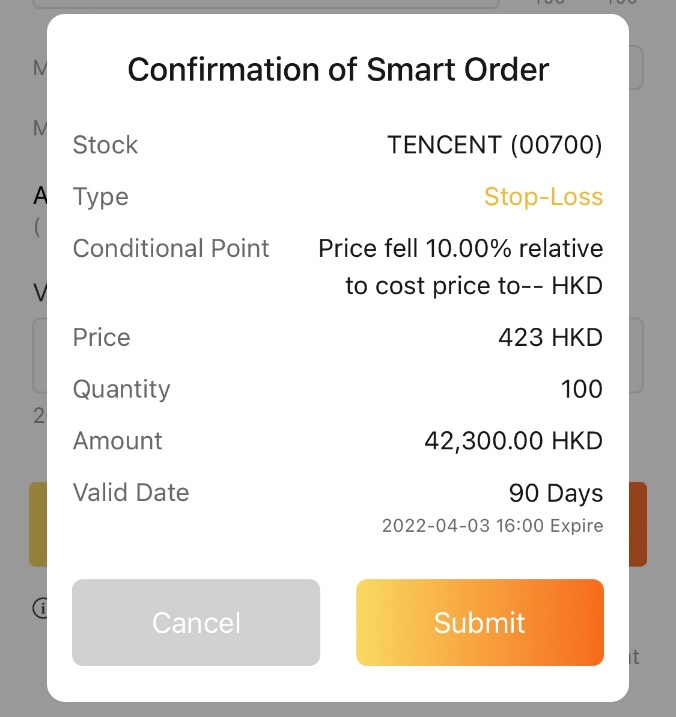

STEP 3 Set the condition

Set the Price and Quantity

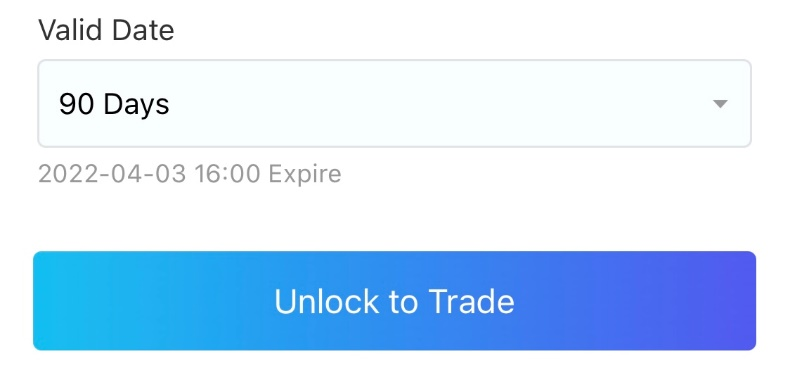

STEP 4 Select effective time and place order

For the valid date, same day/ 2 days/ 3 days/ 1 week/ 2 weeks/ 30 days/ 60 days/ 90 days are available, and can be extended by changing the order.

Click unlock to trade and submit order. The submitted order can be viewed under the smart order page, and the order can be modified as needed.

*You are not allowed to modify if the “Stop-Loss” order has been triggered, but you may cancel the order and place another order again.

Order time

Anytime

Order valid date

Same day/ 2 days/ 3 days/ 1 week/ 2 weeks/ 30 days/ 60 days/ 90 days are available, and can be extended by changing the order.

Please note that if the trigger price is set as the order price and the actual triggering price of the stop-loss sell order is lower than the trigger price specified by the client, the actual triggering price will become the sell price of the order (instead of the client's specified trigger price).